Project Background

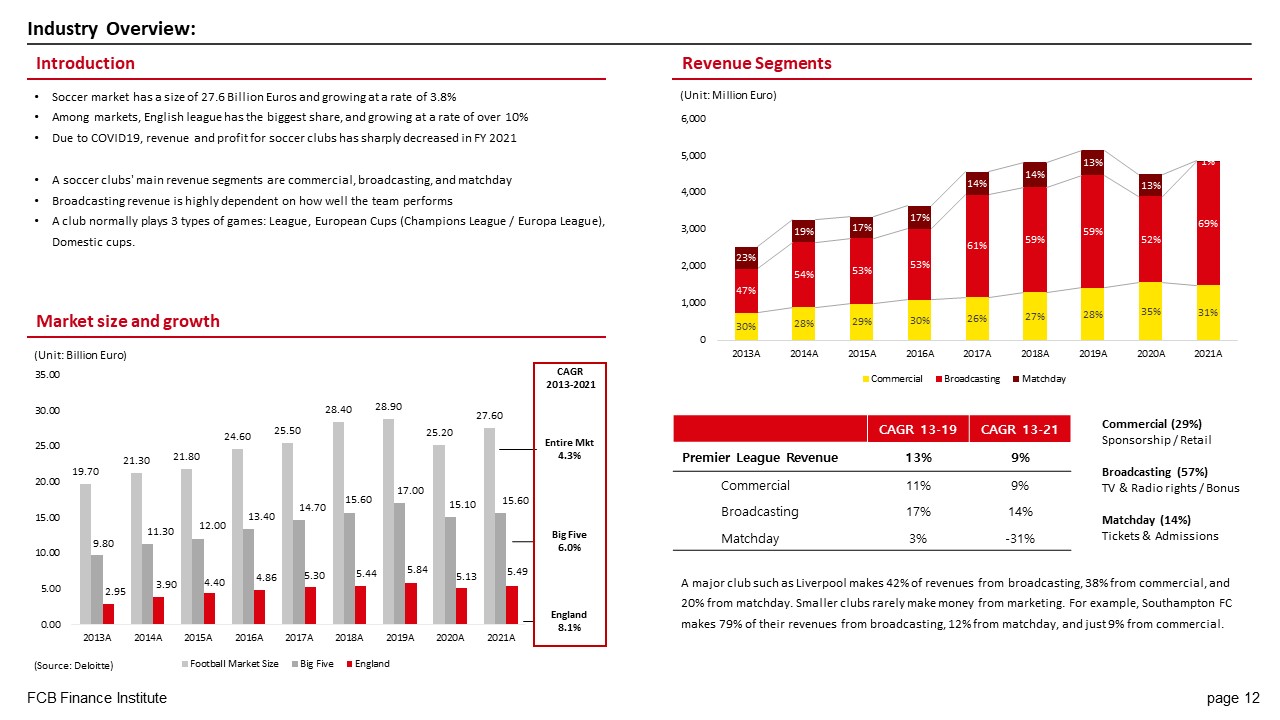

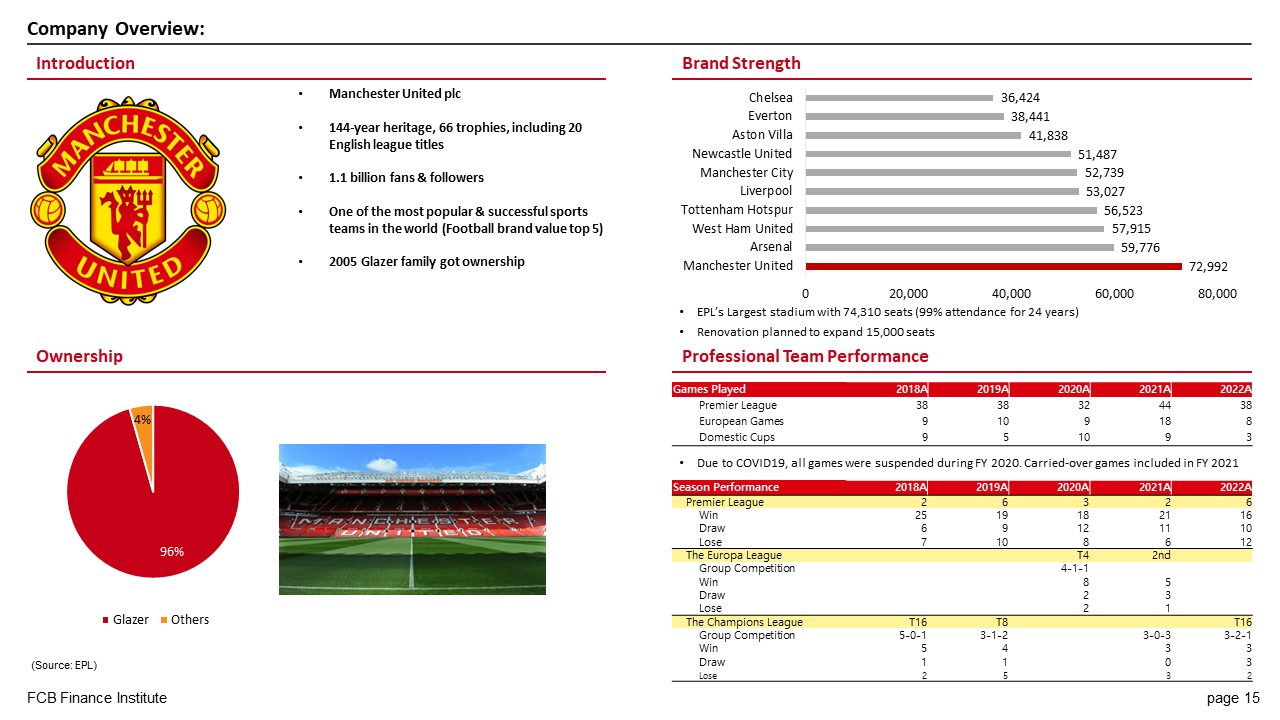

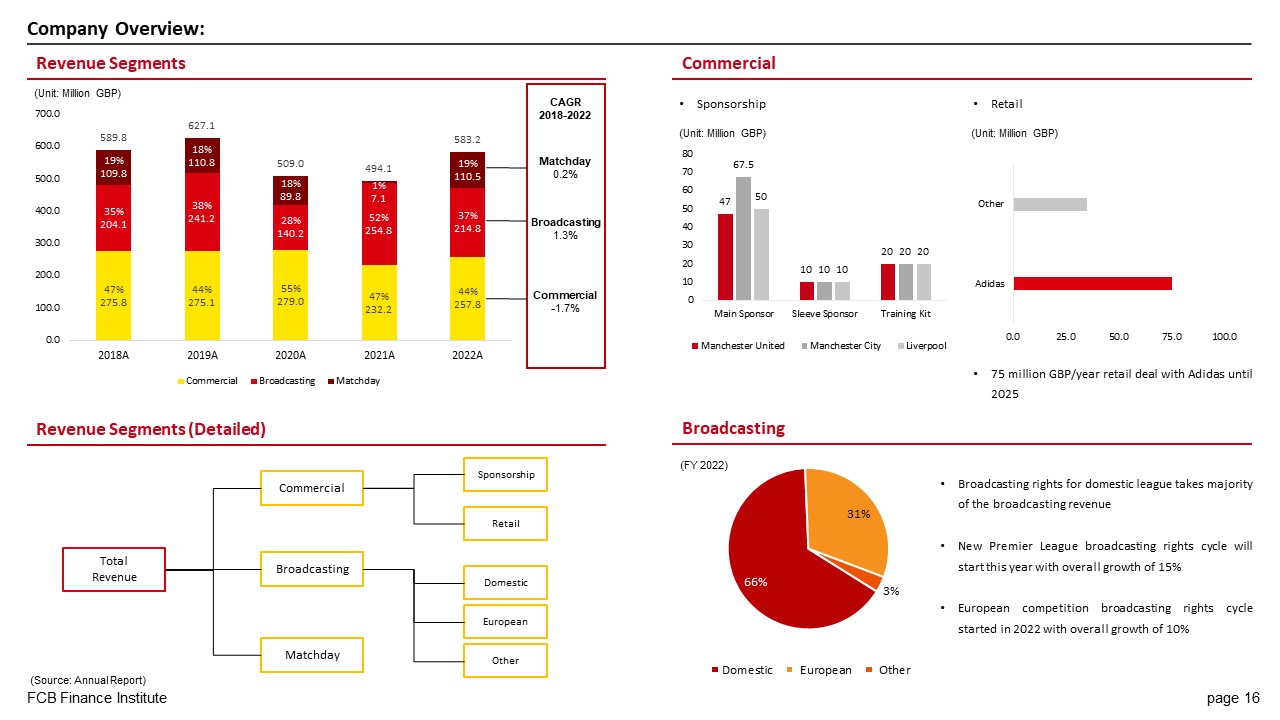

The soccer market was experiencing rapid growth, but the impact of the COVID-19 has slowed its expansion. With the pandemic showing signs of recovery, soccer clubs are being perceived as attractive investment assets from many companies and funds, including Middle East sovereign wealth funds. Manchester United, with the highest level of brand value and performance, is expected to improve its future sales and profitability. Given this, we believe that the club is currently undervalued and are proposing its acquisition through this pitch deck.

- Part 1. Investment Highlight

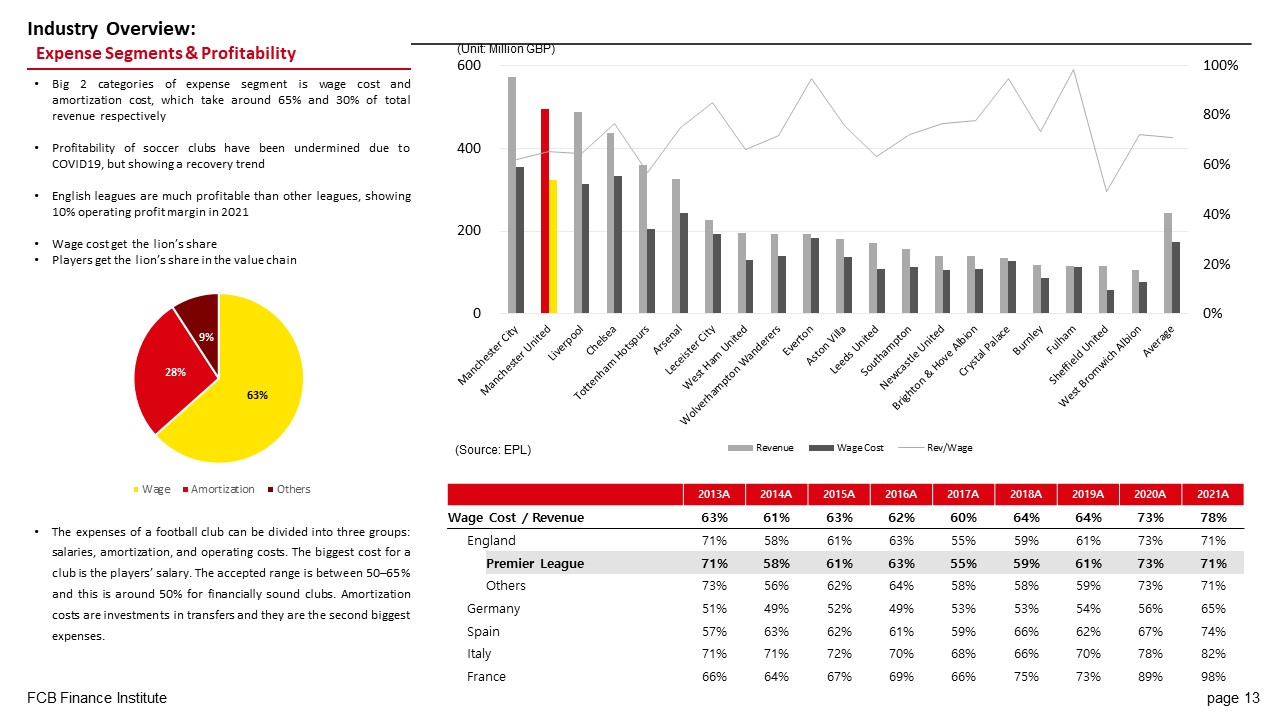

- Part 2. Industry Overview: Football industry competition by regional league in Europe

- Part 3. Target Company Overview: Revenue & Expense forecasts

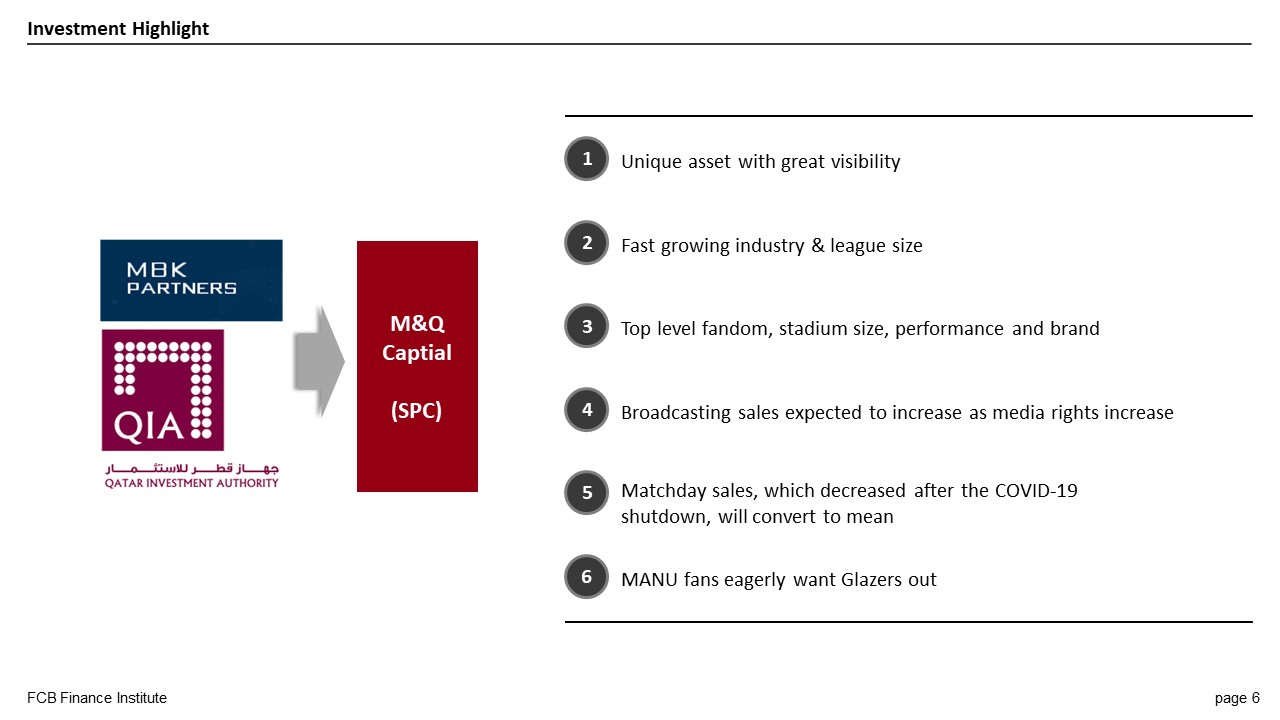

- Part 4. Transaction Overview: MBK Partners & QIA Consortium

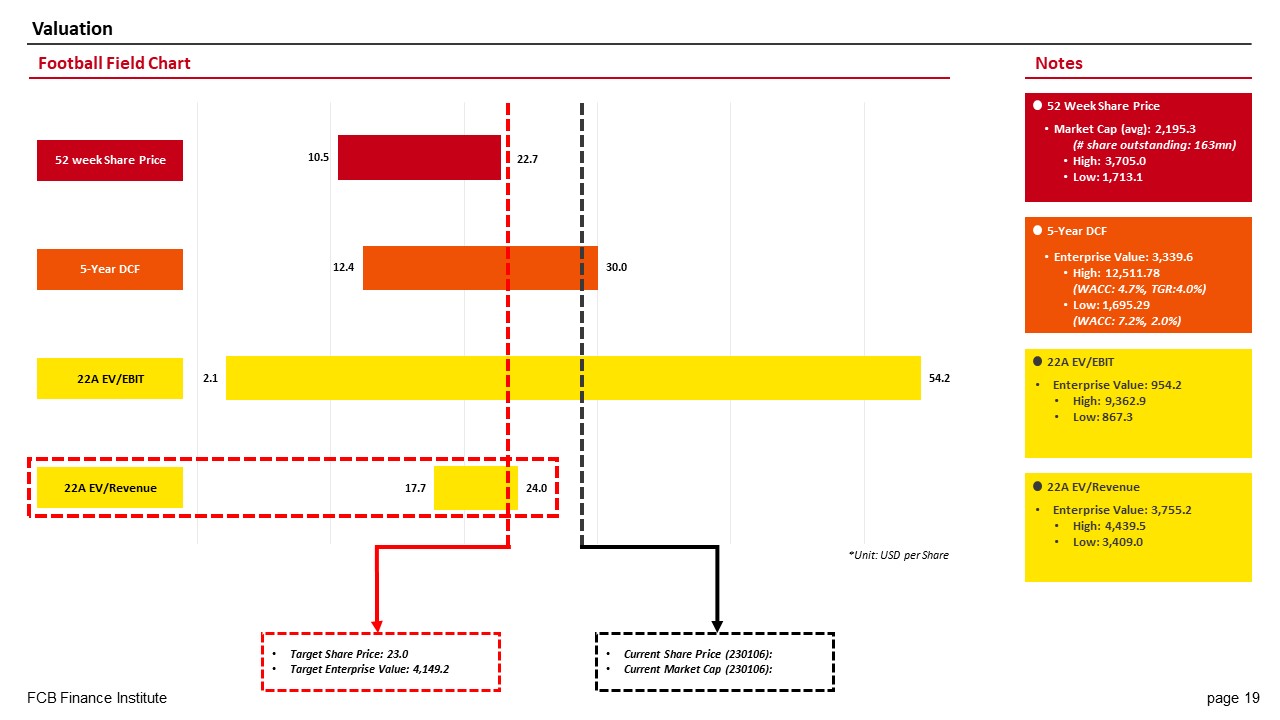

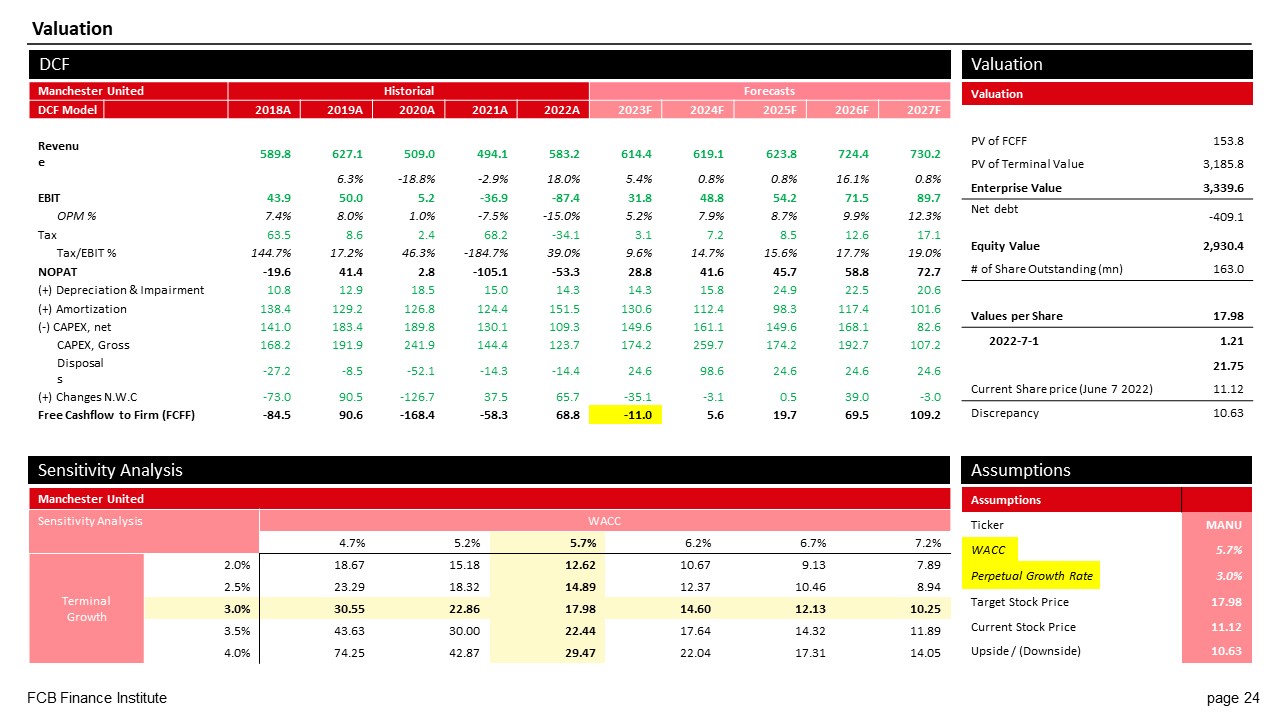

- Part 5. Valuation Overview: Football field chart, DCF

Project Candidate

Park, Min Je

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Jung, Young Han

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Finance Project Portfolio

Part 1. Executive Summary

Part 2. Investment Highlight

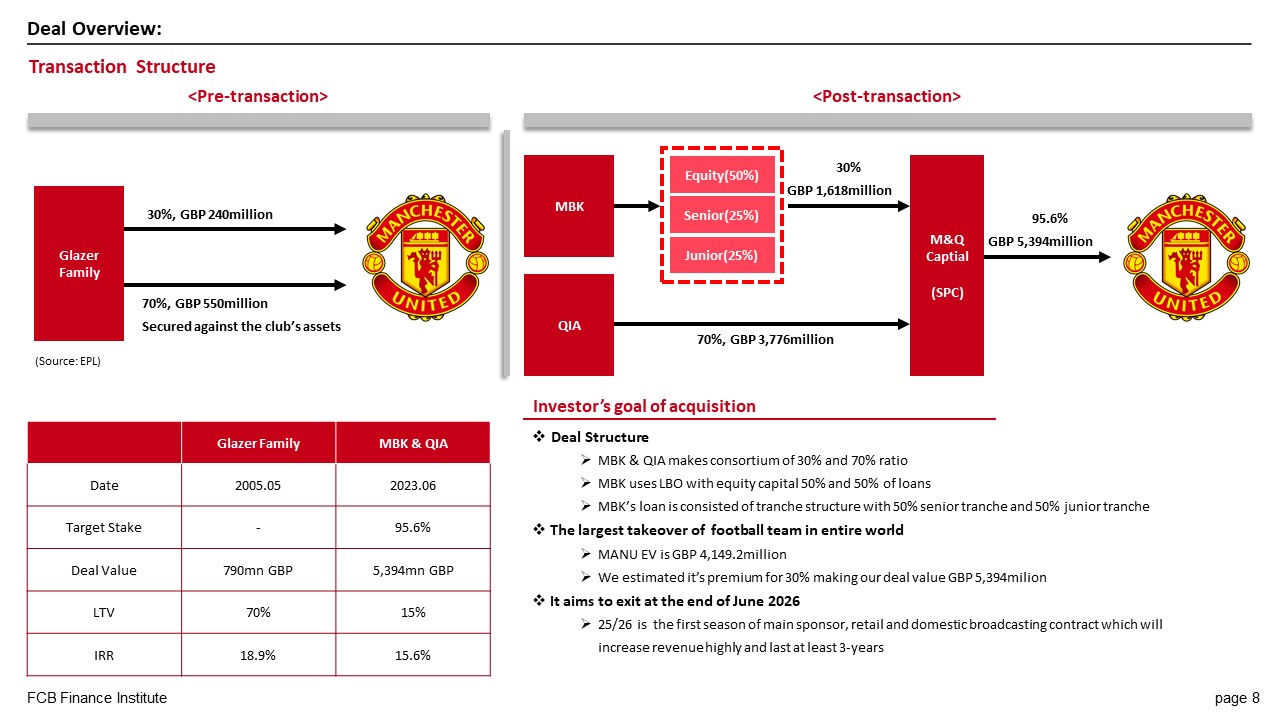

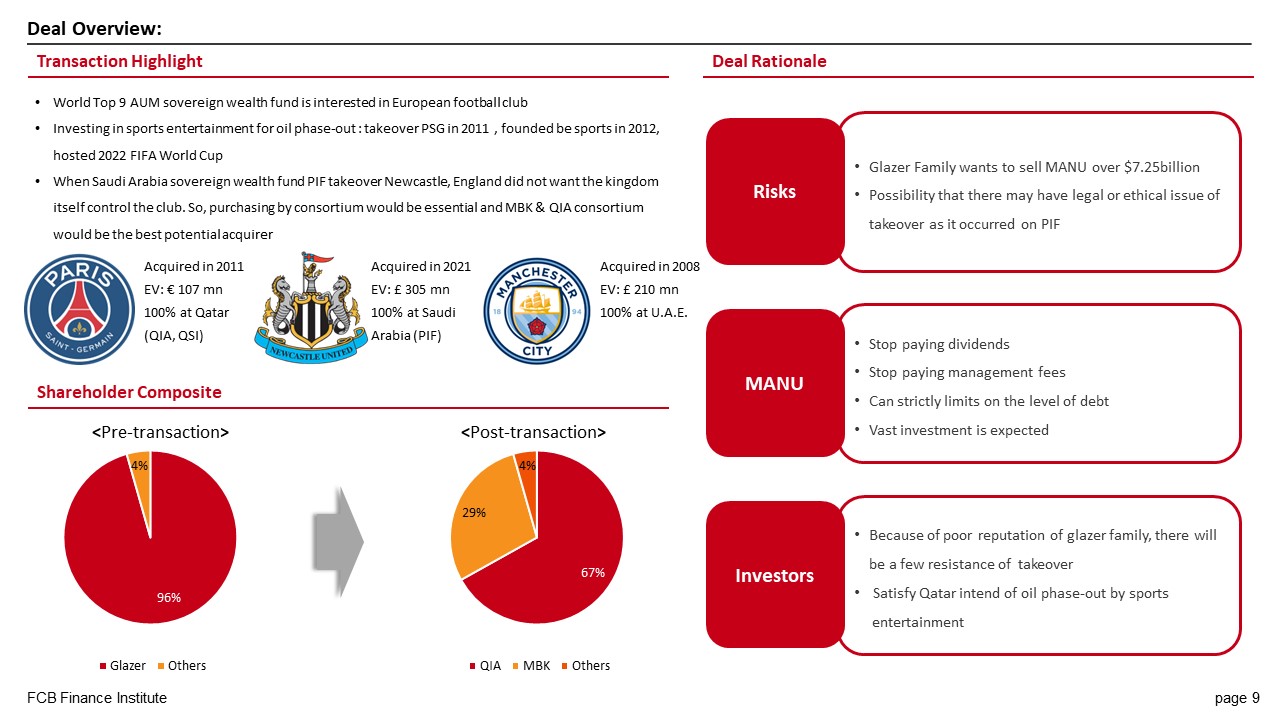

Part 3. Deal Overview: MBK Partners & QIA Consortium

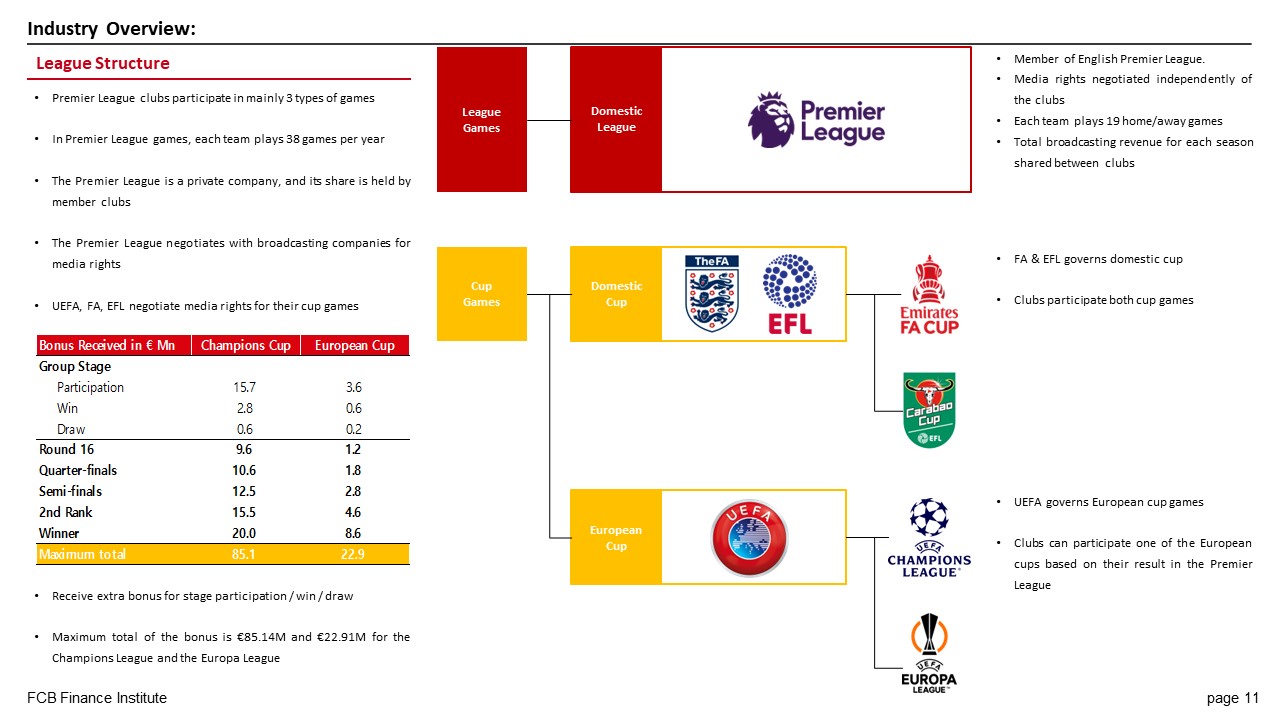

Part 4. Industry Overview: Soccer competition structure by regional league in Europe

Part 5. Target Company Overview: Revenue & Expense forecasts

Join a Finance Project

서류, 면접에서 활용할 금융권 포트폴리오를 만들고 싶으신가요? 프로젝트를 통해 실무와 네트워킹을 한번에 해결할 수 있습니다. 도전하세요!