Project Background

Based on the Heinz and Kraft M&A case, Samyang Foods, Inc., an instant noodles company, was chosen as a new target company considering needs and appetite of Heinz. Instant noodles business will give Heinz strategic advantage through diversification, cost saving and profit maximization. Samyang Foods, Inc presence in APAC is strong., especially ‘Buldak’ the one of the most popular noodle brand in Asia.

- Part 1. Investment Highlight

- Part 2. Industry Overview – Noodles Market, US and Indonesia

- Part 3. Target Company Overview – Samyang Foods, Inc.: Company Overview and Shareholders.

- Part 4. Target Company Overview – Samyang Foods, Inc.: Selling Points

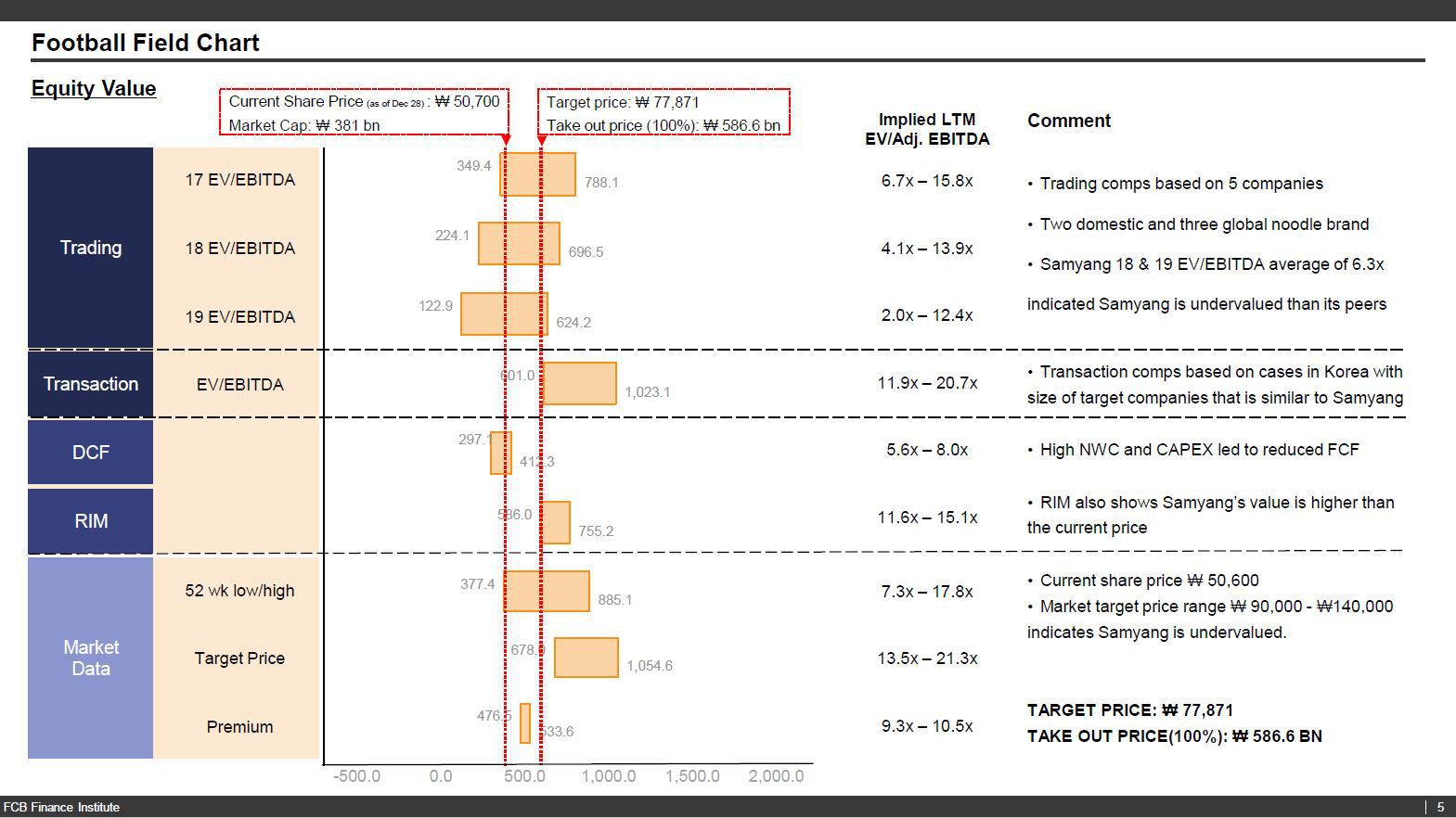

- Part 5. Foot Ball Field Chart

Project Leaders

Shin, Noah

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Kim, So Hee

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Finance Project Portfolio

Part 1. Investment Highlight

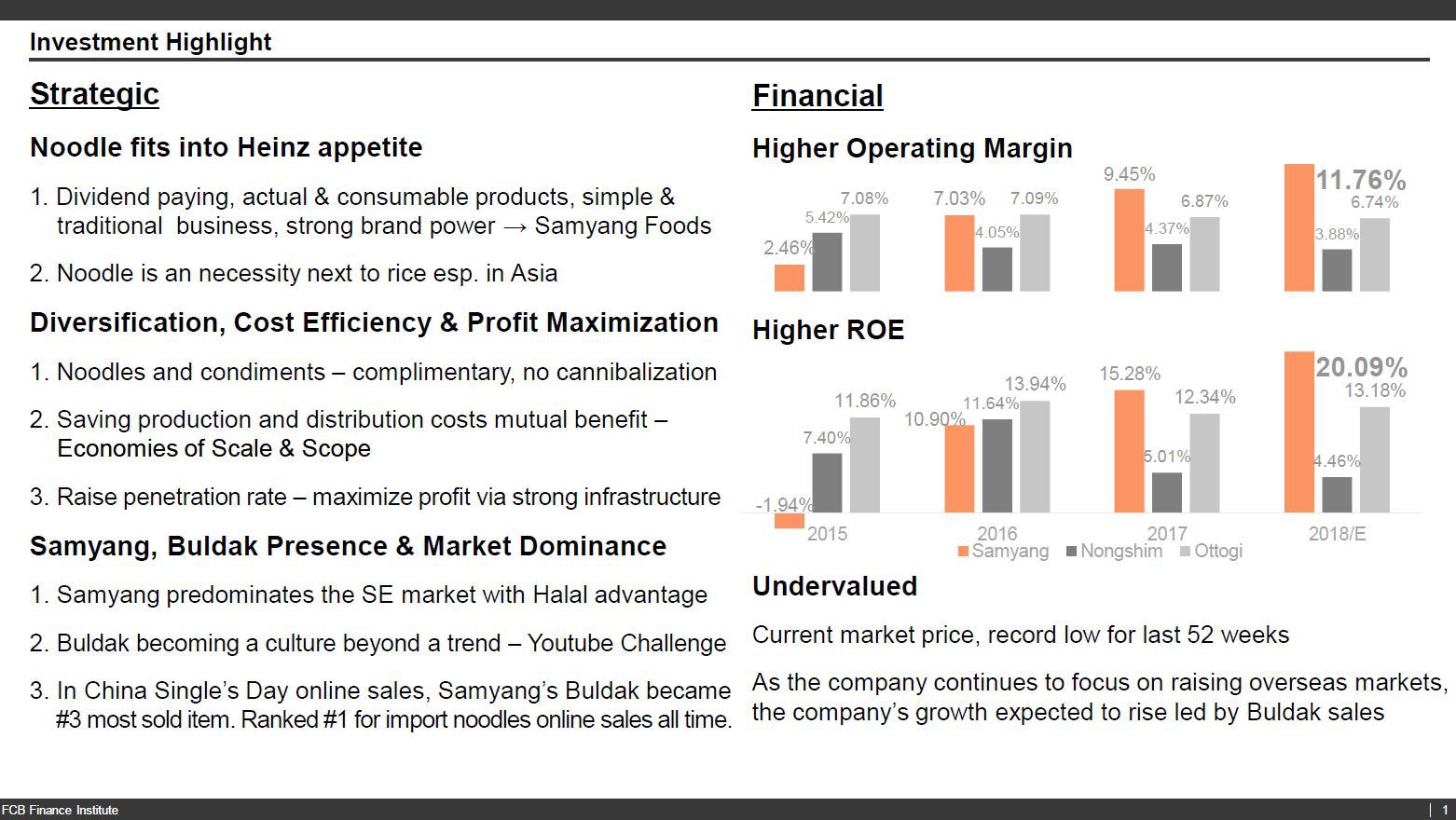

Two major reason why Heinz should acquire Samyang. Strategic and Financial.

First Noodle fits into Heinz appetite as it is dividend paying, actual & consumable products, traditional business, strong brand power, not to mention Noodle is an necessity in Asia. Second noodles and condiments are complementary and Heinz and Samyang can increase the penetration rate via each other’s network and infrastructure. Third Samyang and its Buldak presence is strong.

Financially, Samyang has higher operating margin and ROE than its peers and it is significantly undervalued based on our valuation model.

Part 2. Industry Overview – Noodles Market, US and Indonesia

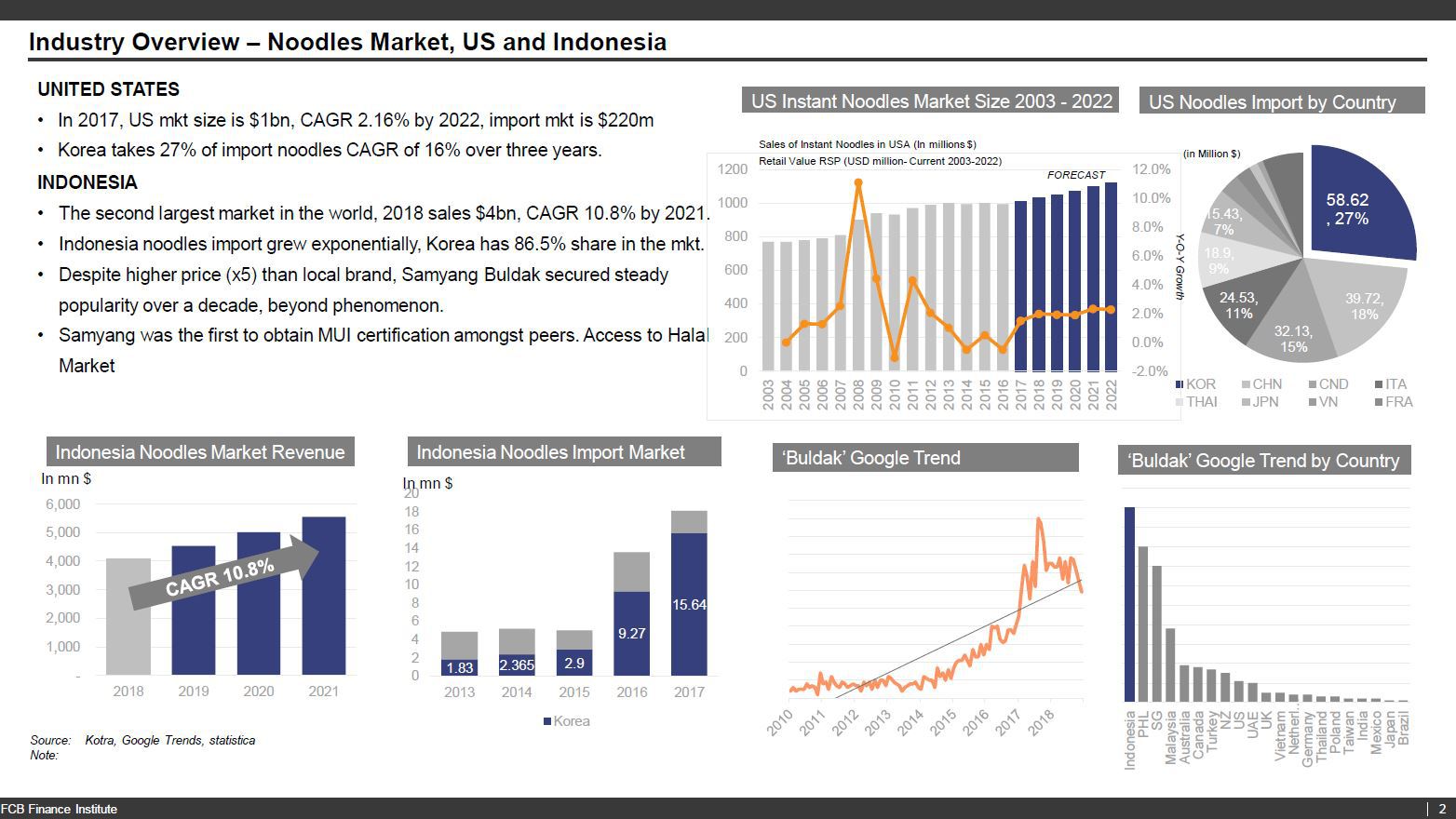

After China, Indonesia is the biggest noodle consuming nation and US is the top second country where Korea noodles are exported most. In US consumption of instant noodles is increasing gradually. Indonesia where Samyang and Buldak has the most advantage thanks to Youtube challenge, noodles market revenue size is currently at $4bn and will grow by 2021 with CAGR 10.8%, also its import market where Korea has 86.5% share grew exponentially. This is meaningful growth as Korea noodles price is much more expensive than local or other import brands. In addition, Buldak is not only a trend but a culture that has maintained for 8 years especially in Indonesia according to Google trend.

Part 3. Target Company Overview – Samyang Foods, Inc.: Company Overview and Shareholders.

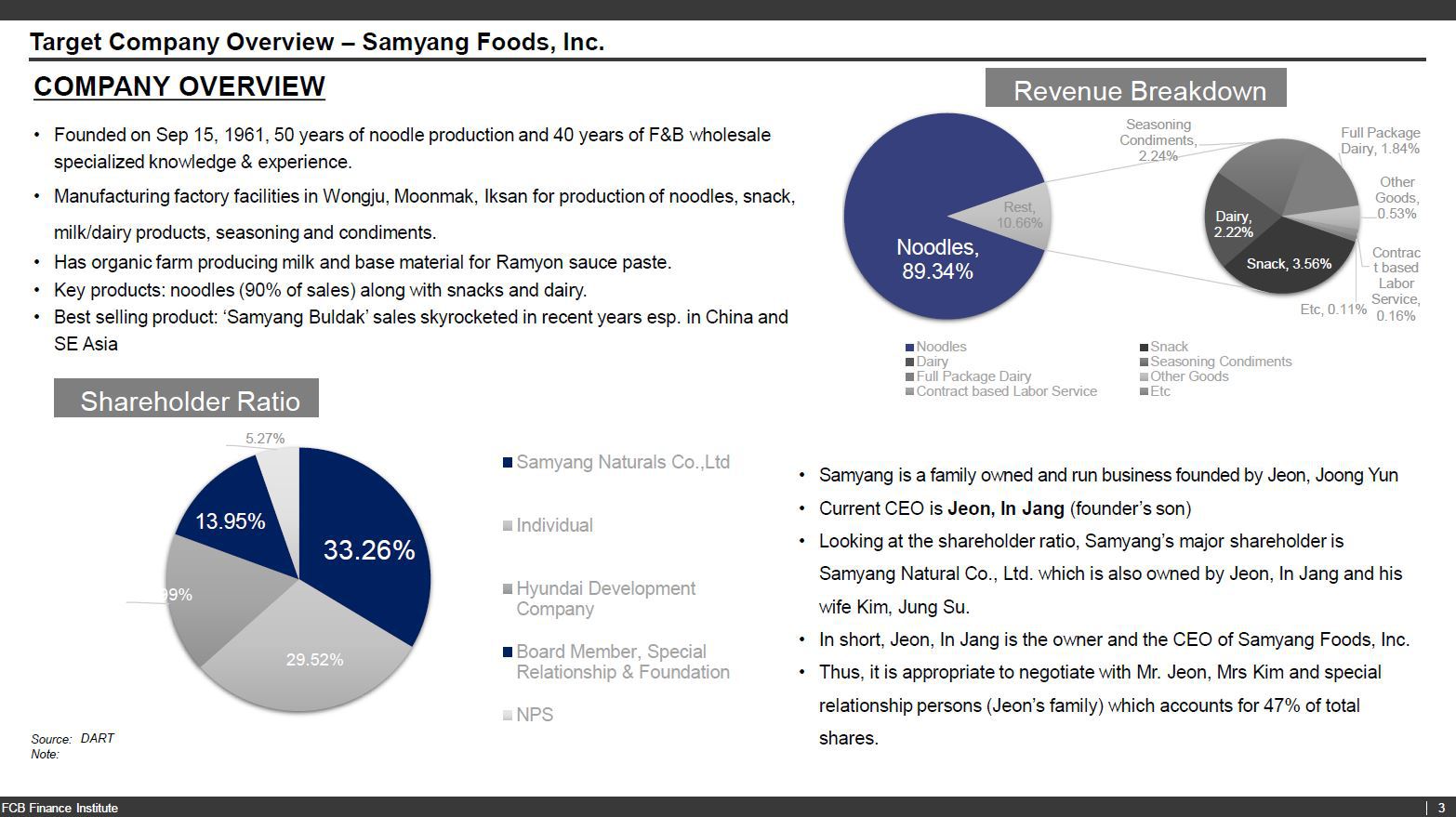

Samyang Foods is famous in Korea for the original Ramyon brand founded in 1961. It mainly focuses in noodles production. As of 3Q 18, Noodles sales account for over 90%. As it started with a family business, Samyang is owned and operated by Jeon, In Jang. And almost half of the shares are owned by Mr Jeon himself and his wife and relatives ie special relationships.

Part 4. Target Company Overview – Samyang Foods, Inc.: Selling Points

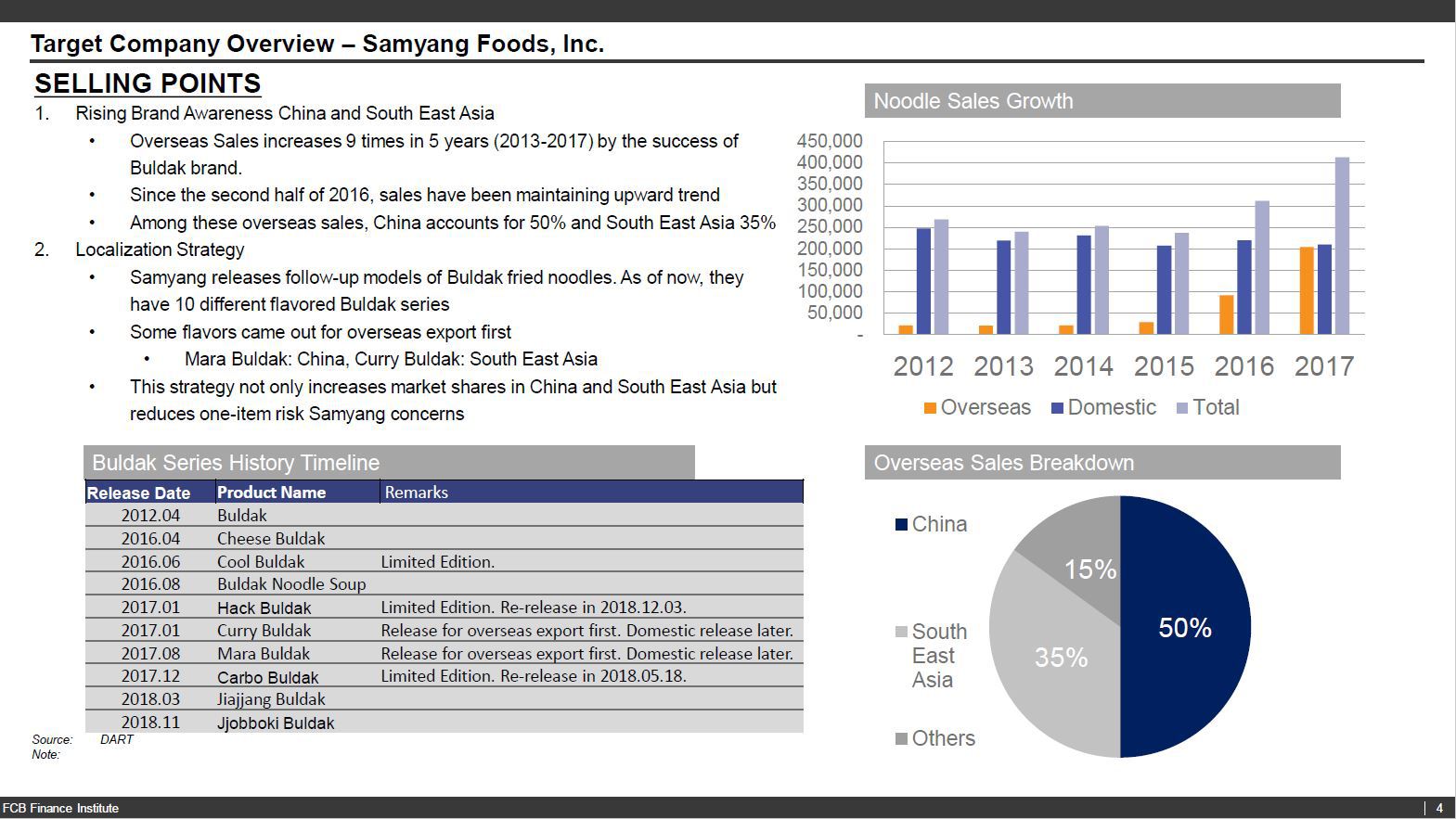

Samyang sales have dramatically increased in 2016 and 2017, and in 2017 overseas sales became equal with domestic sales. The 2017 figure is 9 times higher than that of 2013. 50% of overseas sales are from China and 35% from SE Asia. Further Samyang has adopted localization strategy, so far Buldak has series of 10 Buldak products, increasing the market share in overseas market.

Part 5. Football Field Chart:

We have compiled relative valuations and absolute valuations and compared with market data. For trading comps we have gathered five peers, two from domestic, Nongshim, Ottogi and three from overseas, Nissin, Tingyi and Indofood. All our peers are noodles production company with strong presence in their respective countries. And for transaction we have applied three domestic cases that target companies’ size is similar to our Samyang Foods. We have also ran DCF and RIM model. In conclusion Samyang is significantly undervalued.

Join a Finance Project

서류, 면접에서 활용할 금융권 포트폴리오를 만들고 싶으신가요? 프로젝트를 통해 실무와 네트워킹을 한번에 해결할 수 있습니다. 도전하세요!