Project Background

In this pitchbook we proposed the Hain Celestial Group as a new acquisition target of the Heinz Company, under the assumption that Heinz has not merged with Kraft in 2015. Following consumer preferences towards healthier products has been one of the biggest issues in the industry, and Heinz has also expressed their interest in natural and organic brands. We believe the Heinz Company would successfully enter the organic market and expand its market share by acquiring Hain Celestial, which is a leading organic and natural products company that participates in almost all natural categories with well-known brands.

- Part 1. Investment Highlights – Expected Synergies & Benefits

- Part 2. Target Industry Overview

- Part 3. Target Company Overview – Business Information and Brand Portfolio

- Part 4. Target Company Overview – Financials and Shareholder Structure

- Part 5. Valuation Analysis – DCF Valuation

- Part 6. Valuation Analysis – Overview

Project Leaders

Park, Ju Ri

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Lee, Sang Mo

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Finance Project Portfolio

Part 1. Investment Highlights – Expected Synergies & Benefits

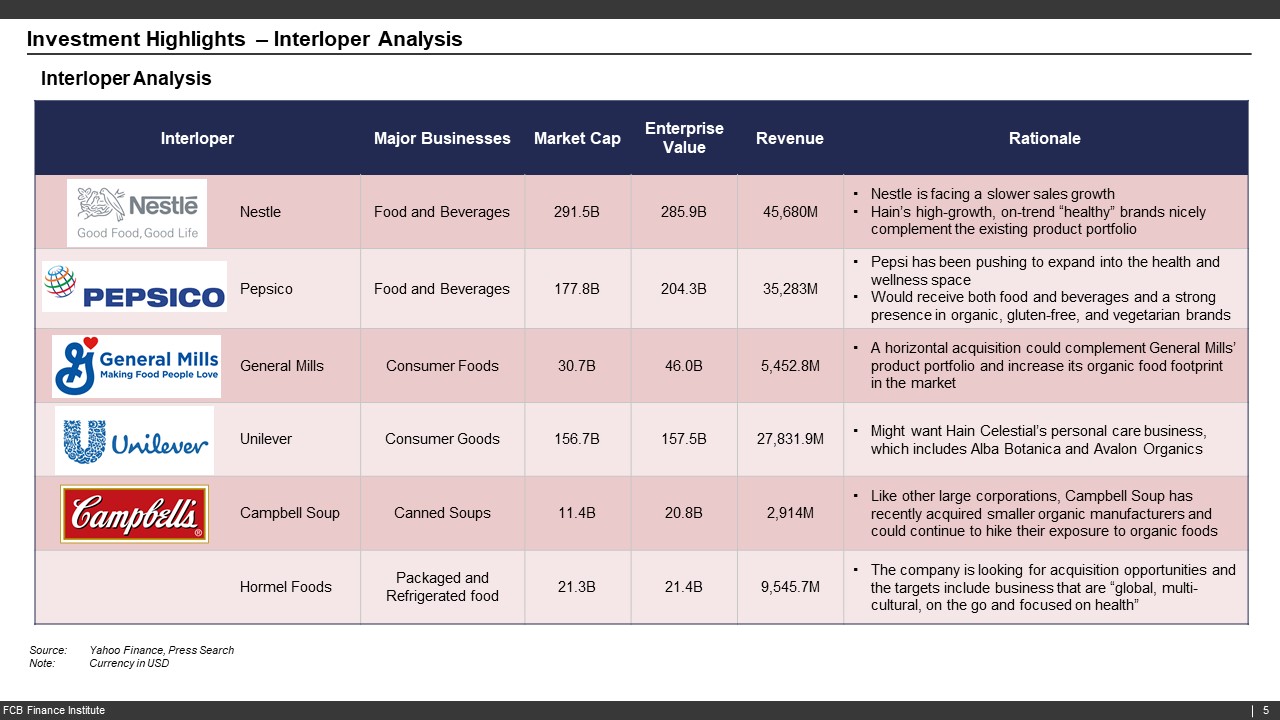

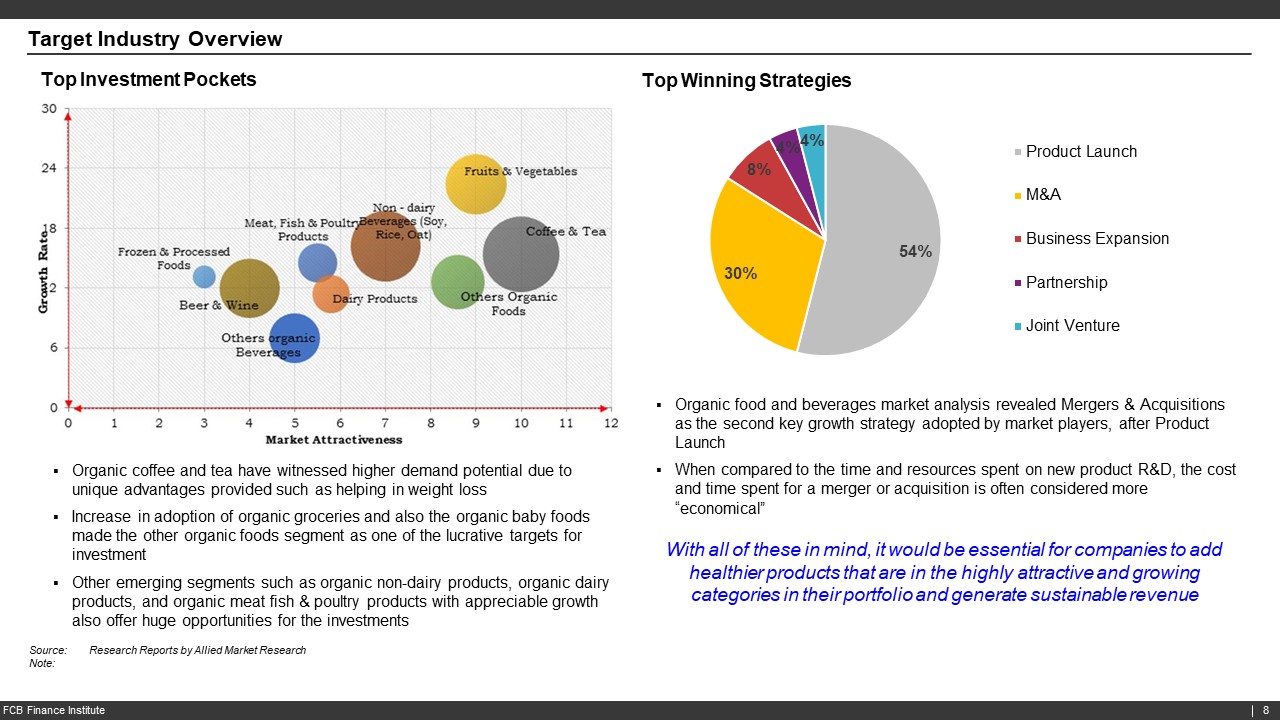

Acquisition of Hain Celestial would create synergies and benefits to the Heinz Company: Diversified portfolio more in line with the consumer trends, higher growth potential and wider consumer base to generate sustainable growth, and cost savings. It accounts for not only SG&A costs but also the opportunity costs for market penetration such as R&D, marketing, and other necessary costs, which could be much higher in the long run.

Part 2. Target Industry Overview

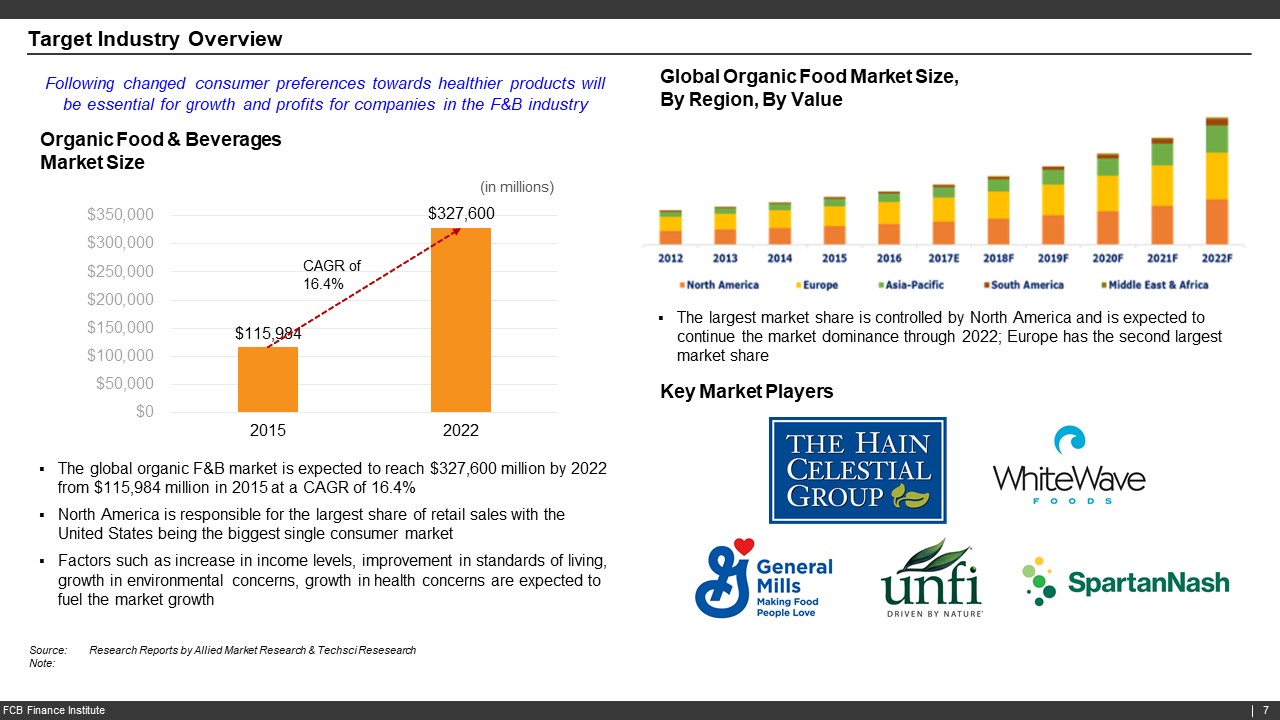

The global organic F&B market is growing at a rapid pace, especially in the U.S market and Europe market. Considering the fact that Hain Celestial is one of the leading companies in the market and the majority of Hain Celestial’s revenue comes from both the U.S and Europe, the company is expected to remain profitable.

Part 3. Target Company Overview – Business Information and Brand Portfolio

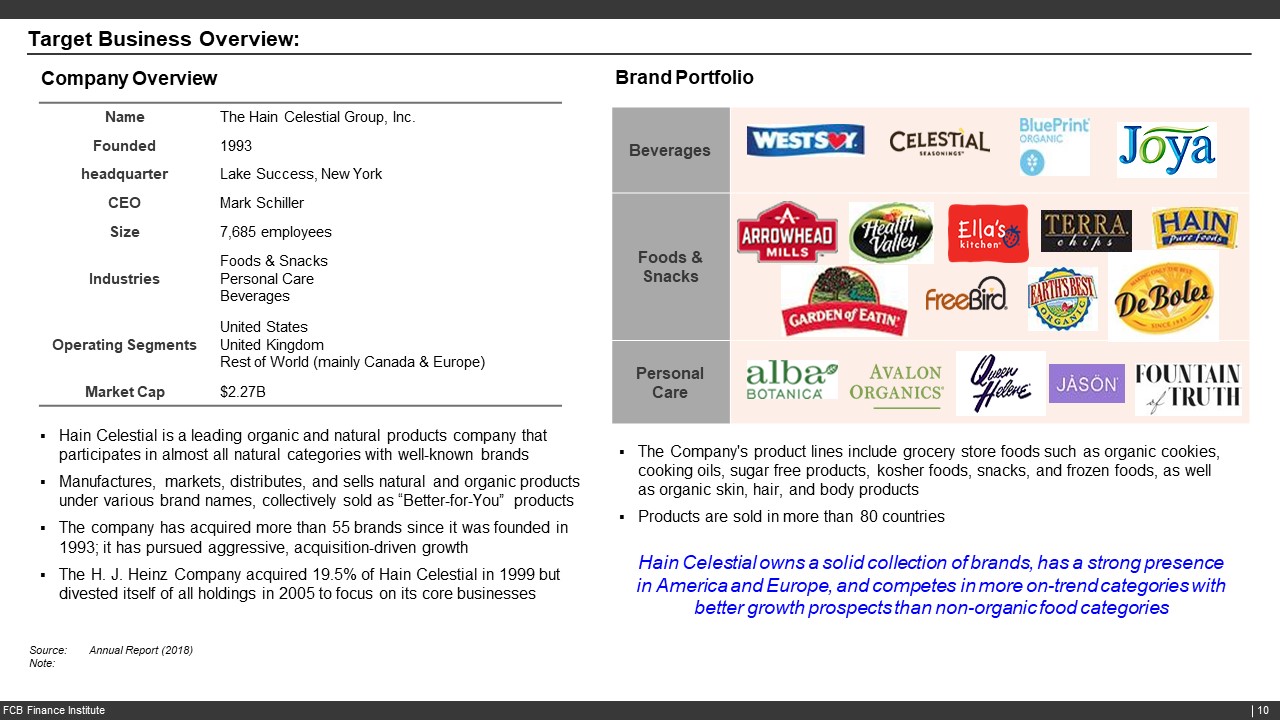

Since inception, the company has principally built the product portfolio via strategic acquisitions. Hain Celestial has a wide variety of brands that are generally well known within their respective categories. The company has a competitive advantage as the first pure-play natural/organic manufacturer; its competitors have neither Hain’s depth of natural and organic products nor their extensive distribution footprint.

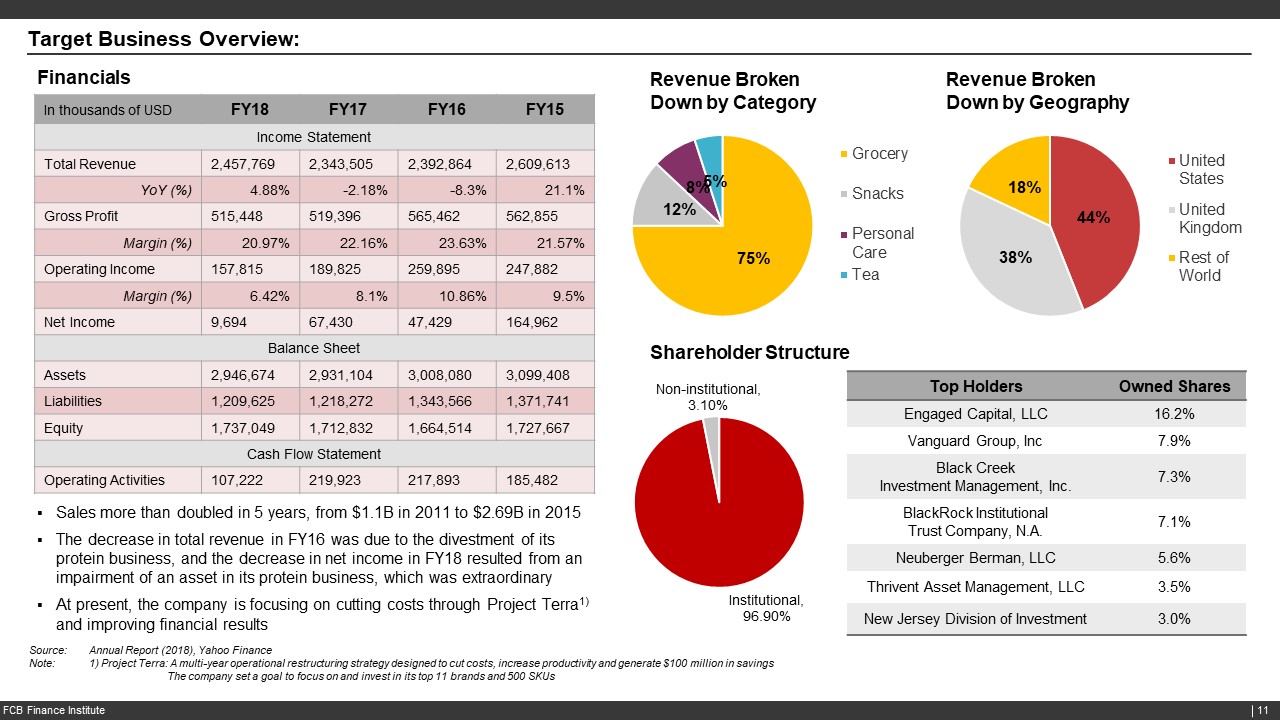

Part 4. Target Company Overview – Financials and Shareholder Structure

Despite the intense competition in the market, Hain Celestial has kept higher average sales growth rate than most of its competitors such as General Mills and Spartannash. Looking at the recent annual growth rate of 4.88%, the company still has more potential in sales growth and profitability once it increases its cost-effectiveness.

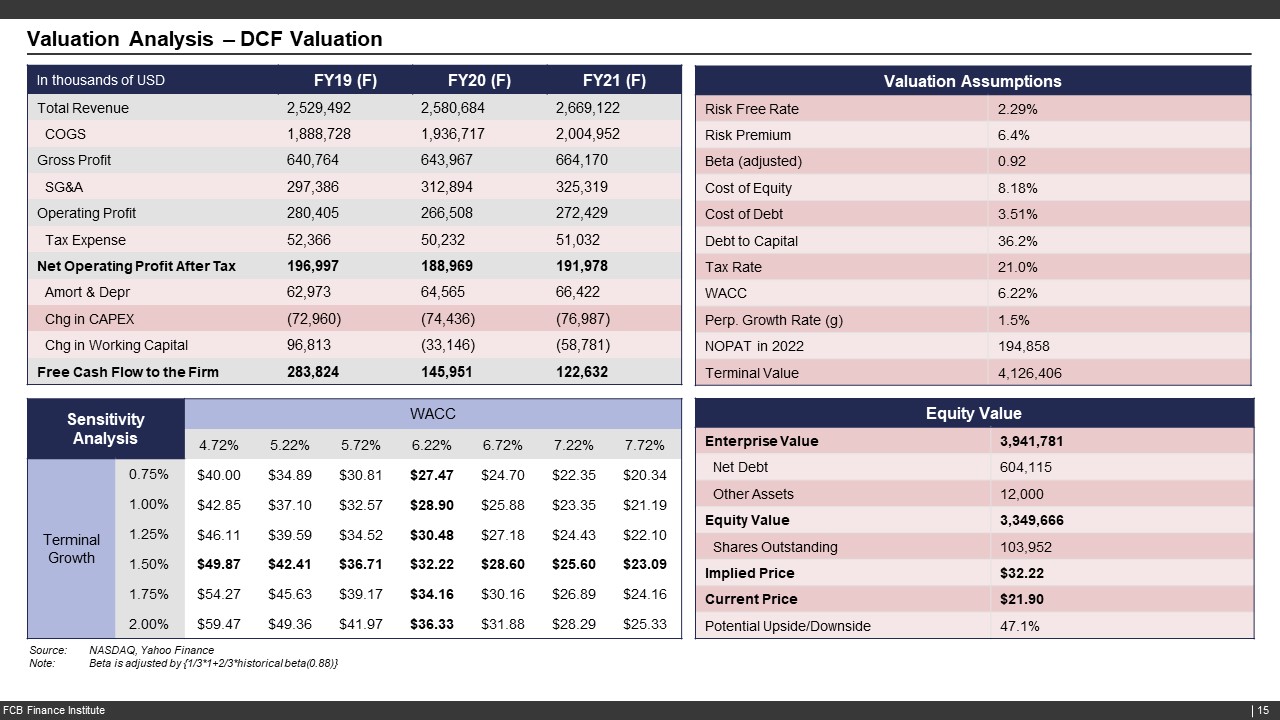

Part 5. Valuation Analysis – DCF Valuation

Assuming a moderate increase in sales and costs, a perpetual growth rate of 1.5%, adjusted beta of 0.92 and WACC of 6.22, we obtained the implied price of $32.22, while the current stock price is at $21.90; therefore the company has a potential upside of 47.1%.

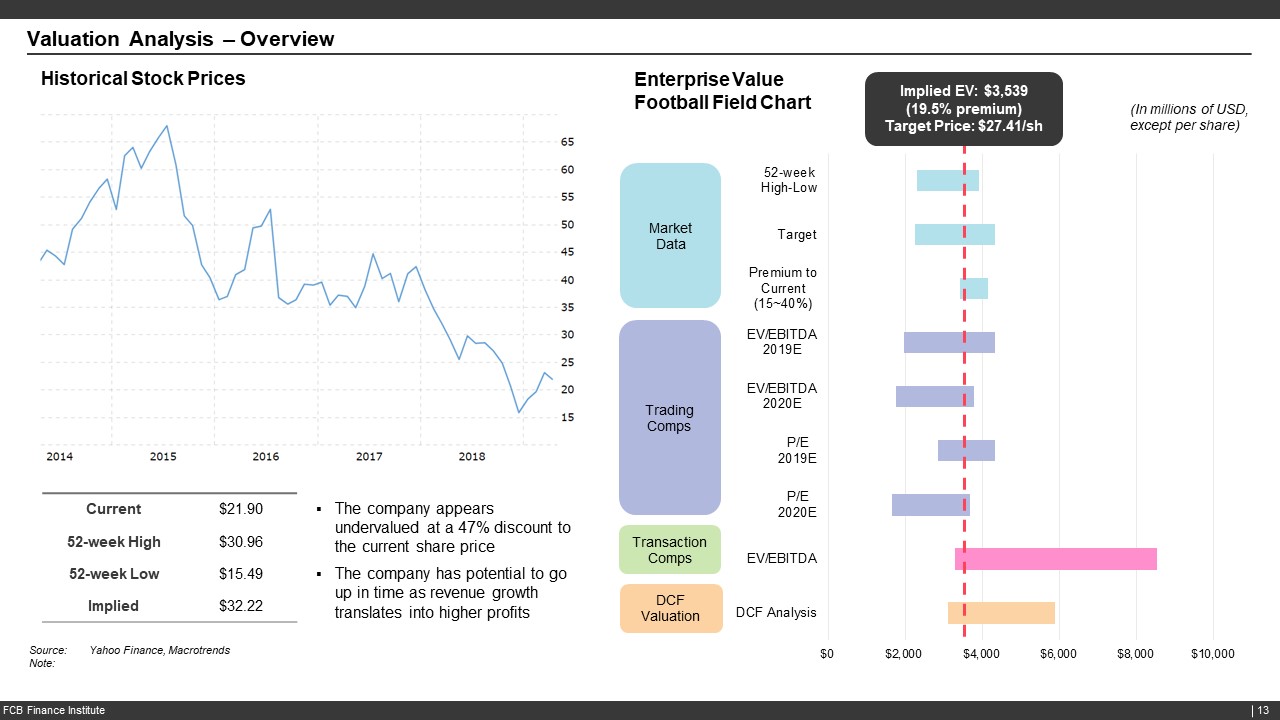

Part 6. Valuation Analysis – Overview

By combining market data, trading and transaction comps and DCF valuation, we chose a target enterprise value of $3,539 million with 19.5% premium to the current share price. According to our valuation model, Hain Celestial’ stock price is likely to rise much higher even though it is currently down due to the temporary factors. Therefore we believe it is the best time to take advantage of acquiring it while the company is being undervalued, at a much lower cost than what it should be.

Join a Finance Project

서류, 면접에서 활용할 금융권 포트폴리오를 만들고 싶으신가요? 프로젝트를 통해 실무와 네트워킹을 한번에 해결할 수 있습니다. 도전하세요!