Project Background

Unilever recently announced its plan to grow fast-growing food business over the next 20-years. Unilever has shown strong interests in various food businesses, especially in active nutrition and well-being products. Correspondingly, we have decided to promote Glanbia PLC: health & wellness company with a strong brand awareness, as a target company. Therefore, acquiring Glanbia PLC will eventually allow Unilever to capture larger market share and achieve higher growth rate within the strikingly competitive food industry.

- Part 1. Executive Summary

- Part 2. Target Business Overview: Glanbia PLC

- Part 3. Investment Highlights: Interpolar Analysis

- Part 4. Target Industry Overview: The Global Active Nutrition Foods and Drinks

- Part 5. Valuation Analysis: Overview and Valuation Football Field Chart

Project Leaders

So, Ha Young

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Yoo, Jun Young

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Chang, Han Byul

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Jung, Na Hyun

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Lee, Soo Jin

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Finance Project Portfolio

Part 1. Executive Summary

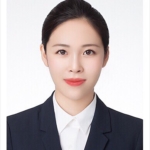

Glanbia PLC operates as a global nutrition company. It operates through three segments: Glanbia Performance Nutrition, Glanbia Nutritionals, and Glanbia Joint Venture. The industry in which Glanbia’s products fall includes the functional food and sports nutrition market, which is projected to grow at a CAGR of 8% over 2018 – 2013. Glanbia PLC’s operating performance comparison between historical and projection period implies relatively lower enterprise value, EBITDA multiple, and share price. The two expected synergies between Unilever and Glanbia include revenue synergy and cost synergy.

Part 2. Target Business Overview

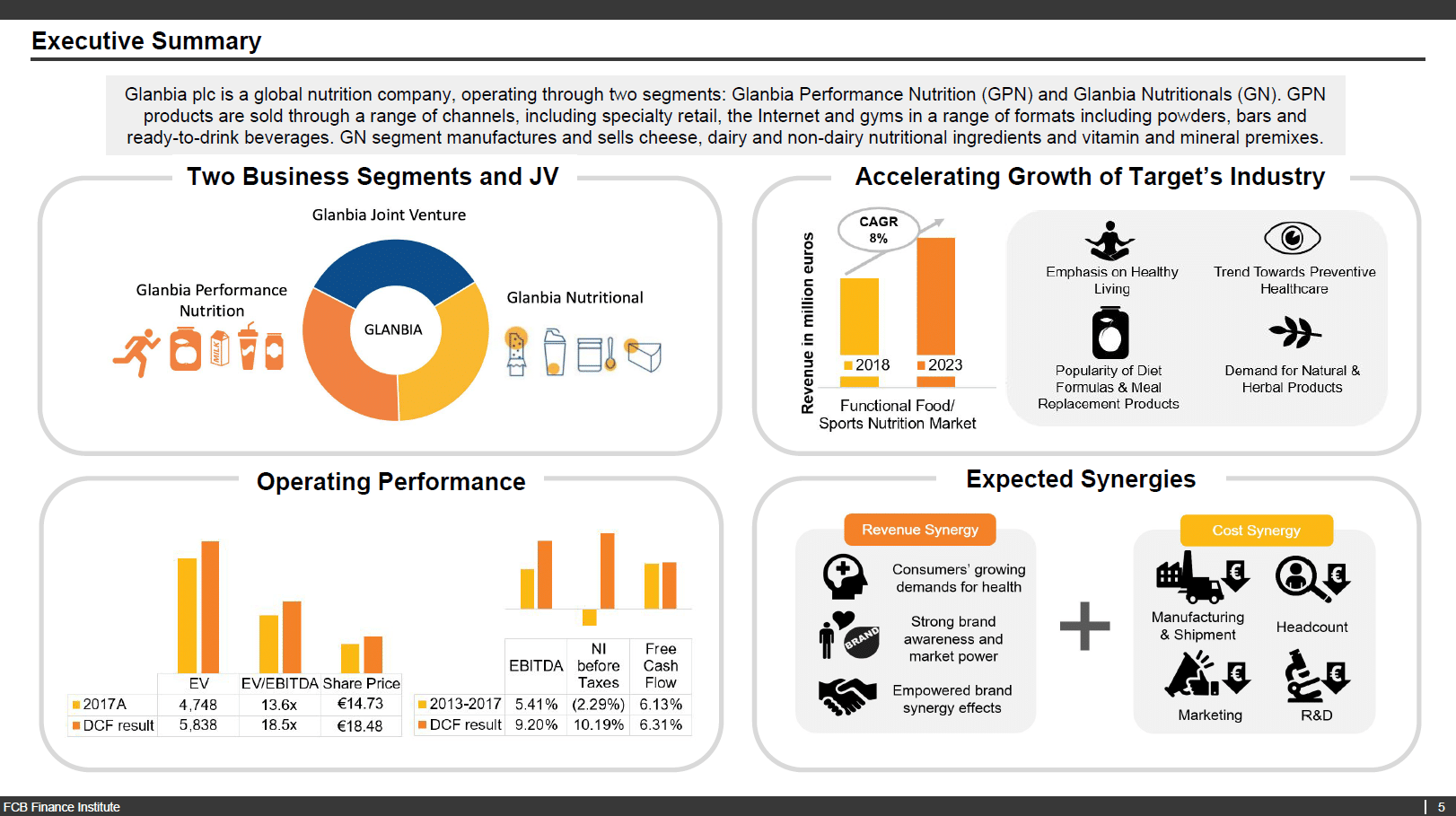

As a global nutrition company, Glanbia PLC has established its market power within the sports nutrition market. Glanbia not only strengthened its product portfolio internally, but also has grown its segments through active acquisition deals. Glanbia seeks to grow its business targeting the APAC market, due to the growing demand of nutritional products within the region. Currently, 72% of Glanbia’s sales come from the U.S., and the rest are from Europe, Australia, and other region. Glanbia’s two segments, Glanbia Performance Nutrition and Glanbia Nutritionals counts for portion of sales of 53% and 47%, respectively. Glanbia Co-operative Society holds the largest share of 31% among the top 5 shareholders.

Part 3. Investment Highlights – Interloper Analysis

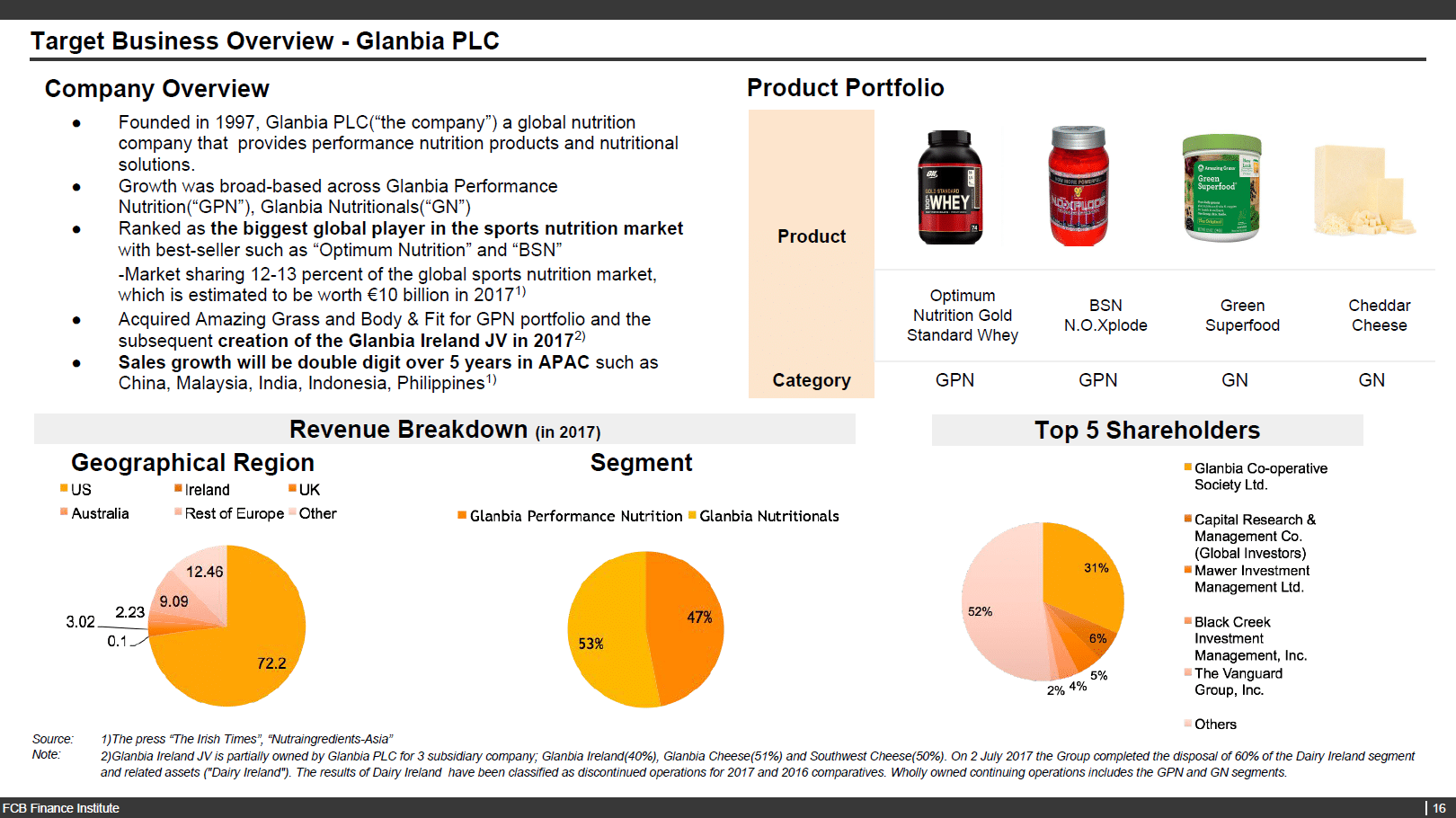

Glanbia PLC’s interlopers were selected based on the size of the market capitals and their investment interest toward healthcare nutrition and dairy products. For instances, Nestle announced to diversify its product portfolio by focusing on infants products and nutrition health, Danone has announced extension plans in the health-food-drinks segments, and Coca Cola started to invest on nutritional and functional beverages due to decreased revenue from carbonated drinks. General Mills established venturing arm – 301 INC that recently led $40m USD in plant-based food and beverage brand.

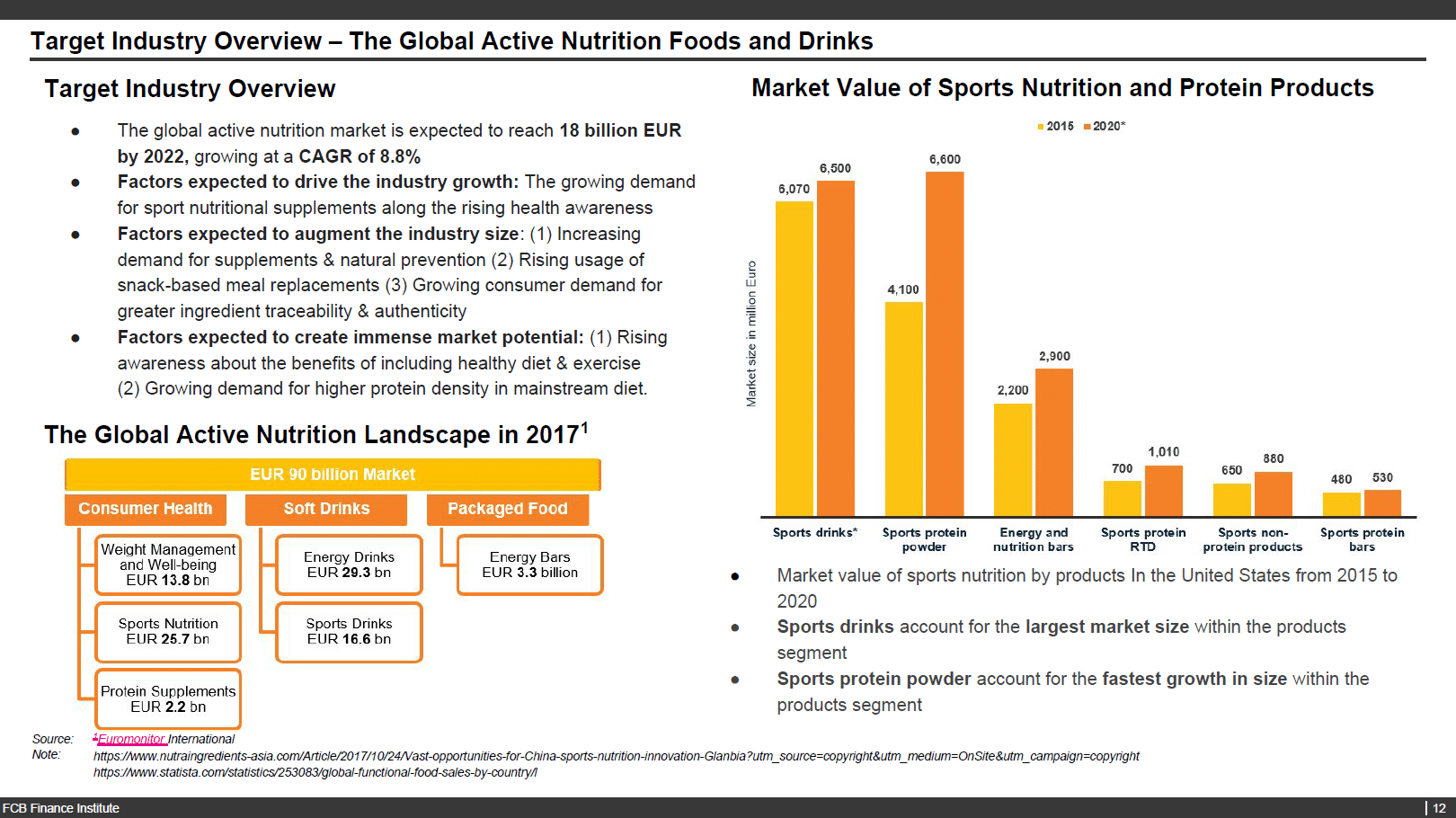

Part 4. Target Industry Overview – The Global Active Nutrition Foods and Drinks

The global active nutrition foods and drinks market is a fast-growing market, which is expected to reach EUR 18 billion by 2022. The global active nutrition market is projected to make EUR 90 billion market, including three major segments: 1) consumer health 2) soft drinks 3) packaged food. Such an outstanding growth rate in global active nutrition market can be substantiated by different factors: 1) increasing demand for supplements & natural prevention 2) rising usage of snack-based meal replacements 3) growing consumer demand for greater ingredient traceability & authenticity. The global active nutrition industry encompasses various business segments such as consumer health, soft drinks, and packaged food. Sports nutrition, in particular, occupies EUR 26.7 billion in consumer health segment. Referring to the ‘Market Value of Sports Nutrition and Protein Products’ graph, sports protein powder accounts for the fastest growth in size within the products segment.

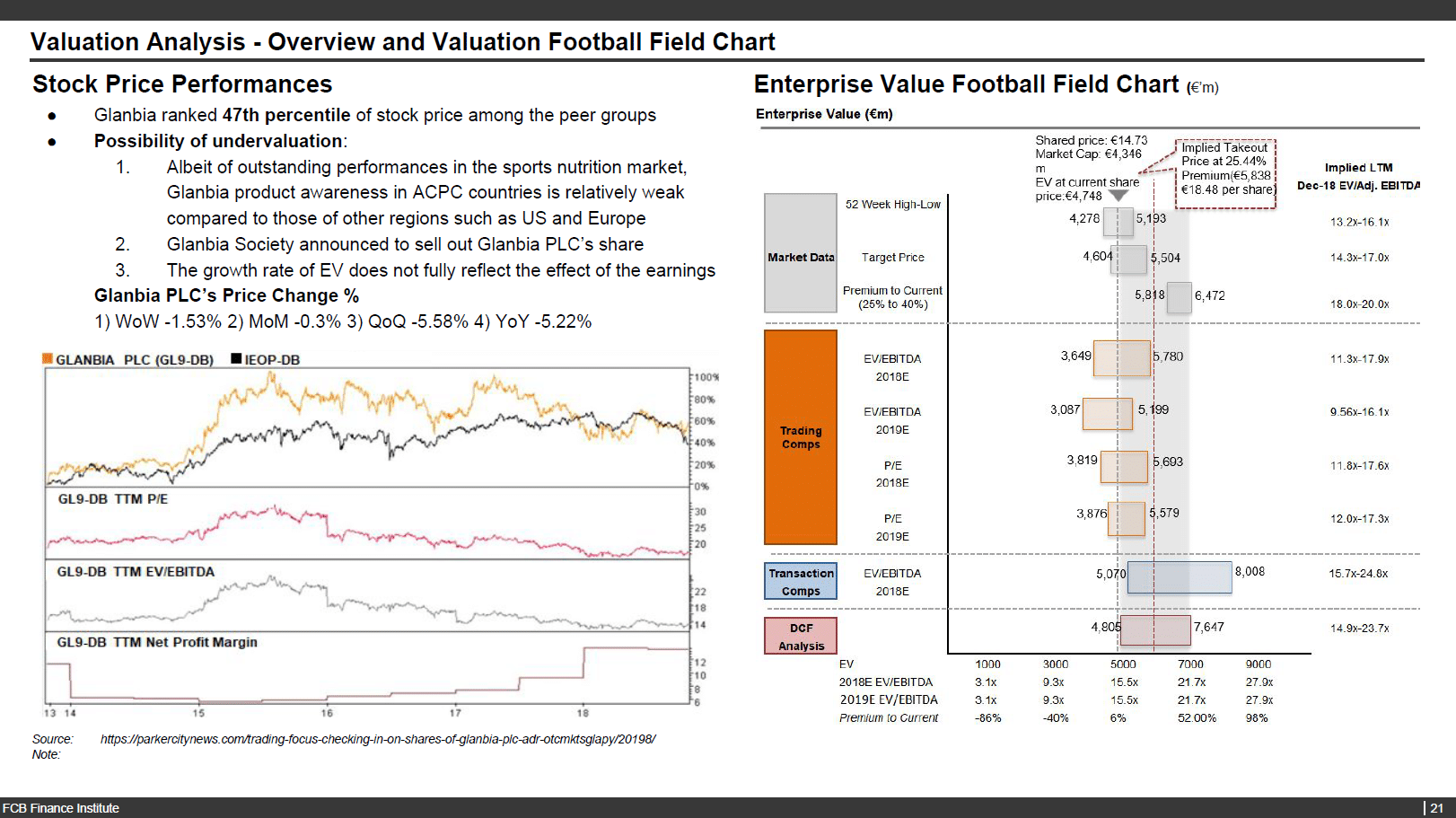

Part 5. Valuation Analysis: Overview and Valuation Football Field Chart

Stock price performances of Glanbia PLC are relatively undervalued compared to those of other peer groups in behalf of three critical reasons: 1) Albeith of outstanding performances in the sports nutrition market, Glanbia`s product awareness in ACPC is rather weak compared to those of other regions such as US and Europe. 2) Glanbia Society announced to sell out Glanbia PLC`s share. 3) The growth rate of EV does not fully reflect the effect of the earnings.

In conclusion, the implied takeout price measured through valuation analyses is €5.9B – premium of 25.44%, share price of €18.48 per share.

Join a Finance Project

서류, 면접에서 활용할 금융권 포트폴리오를 만들고 싶으신가요? 프로젝트를 통해 실무와 네트워킹을 한번에 해결할 수 있습니다. 도전하세요!