Campbell Soup M&A Pitch Book

Project Background

This pitch book proposes acquisition of Campbell Soup to Kraft Heinz. Since Kraft Heinz and Campbell Soup have overlapping manufacturing facilities and distribution channels in USA, Canada, and Indonesia, vertical integration of intermediated goods can enable cost efficient production. In addition, both Kraft Heinz and Campbell Soup can reallocate unfinished goods and decrease the percentage of unfinished goods. Furthermore, Kraft Heinz can enter new market through the acquisition of Campbell Soup, leader in global soup market. Therefore, Kraft Heinz can expand its product portfolio and market share in F&B industry.

- Part 1. Target Industry Overview – US F&B Market

- Part 2. Target Industry Overview – US F&B Market Trends

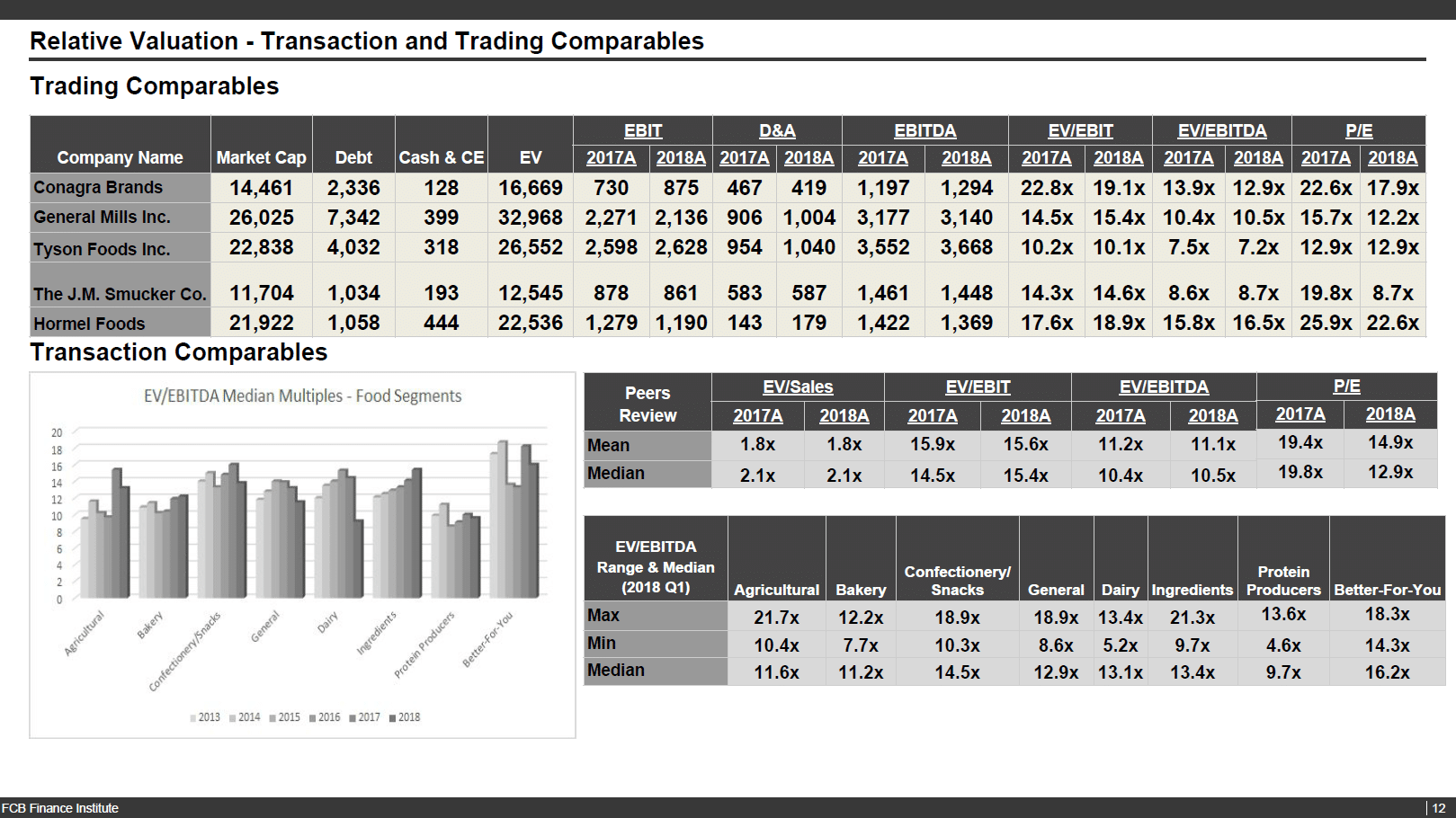

- Part 3. Transaction Overview – Campbell Soup Financial Analysis

- Part 4. Investment Rationale

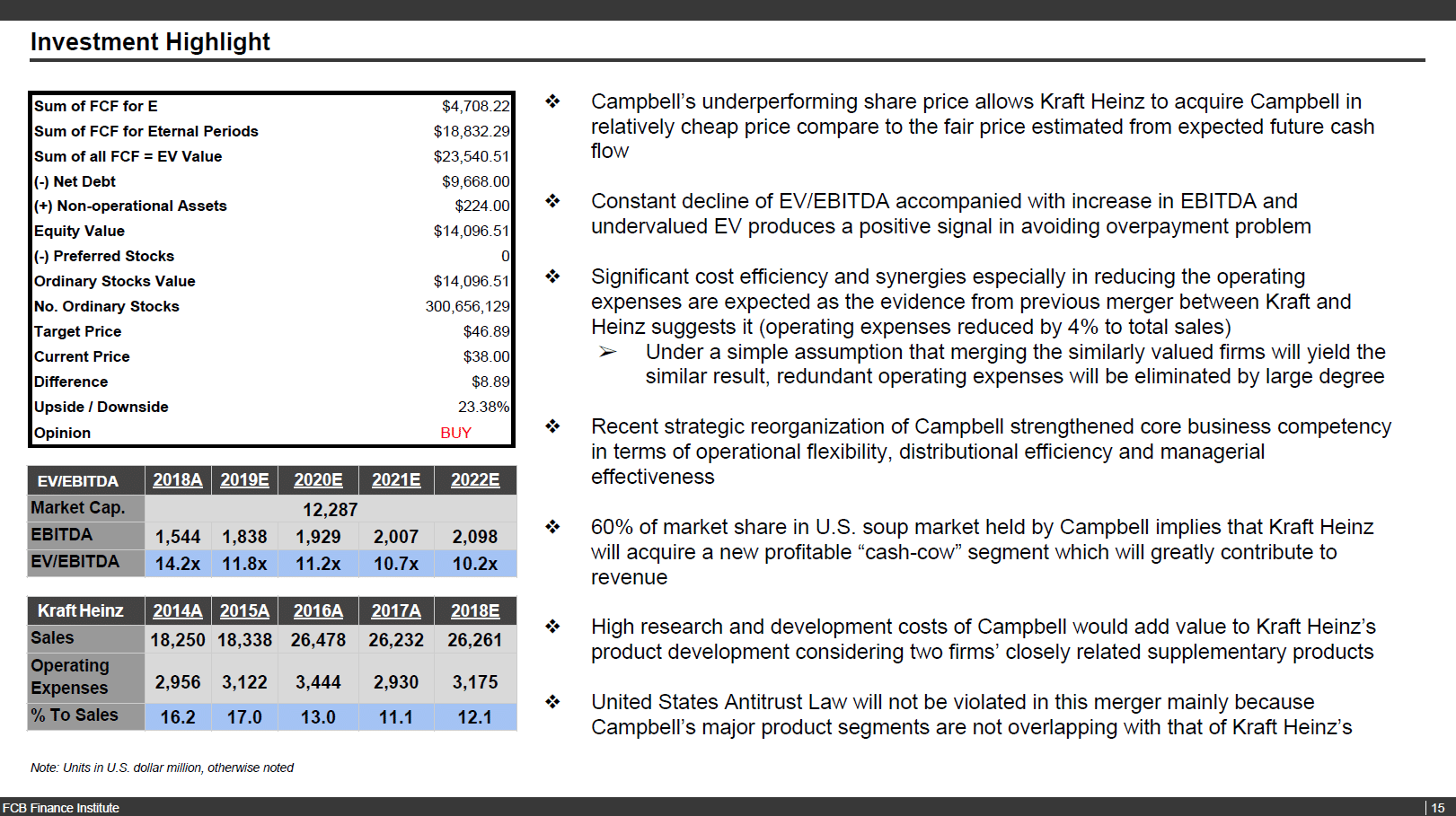

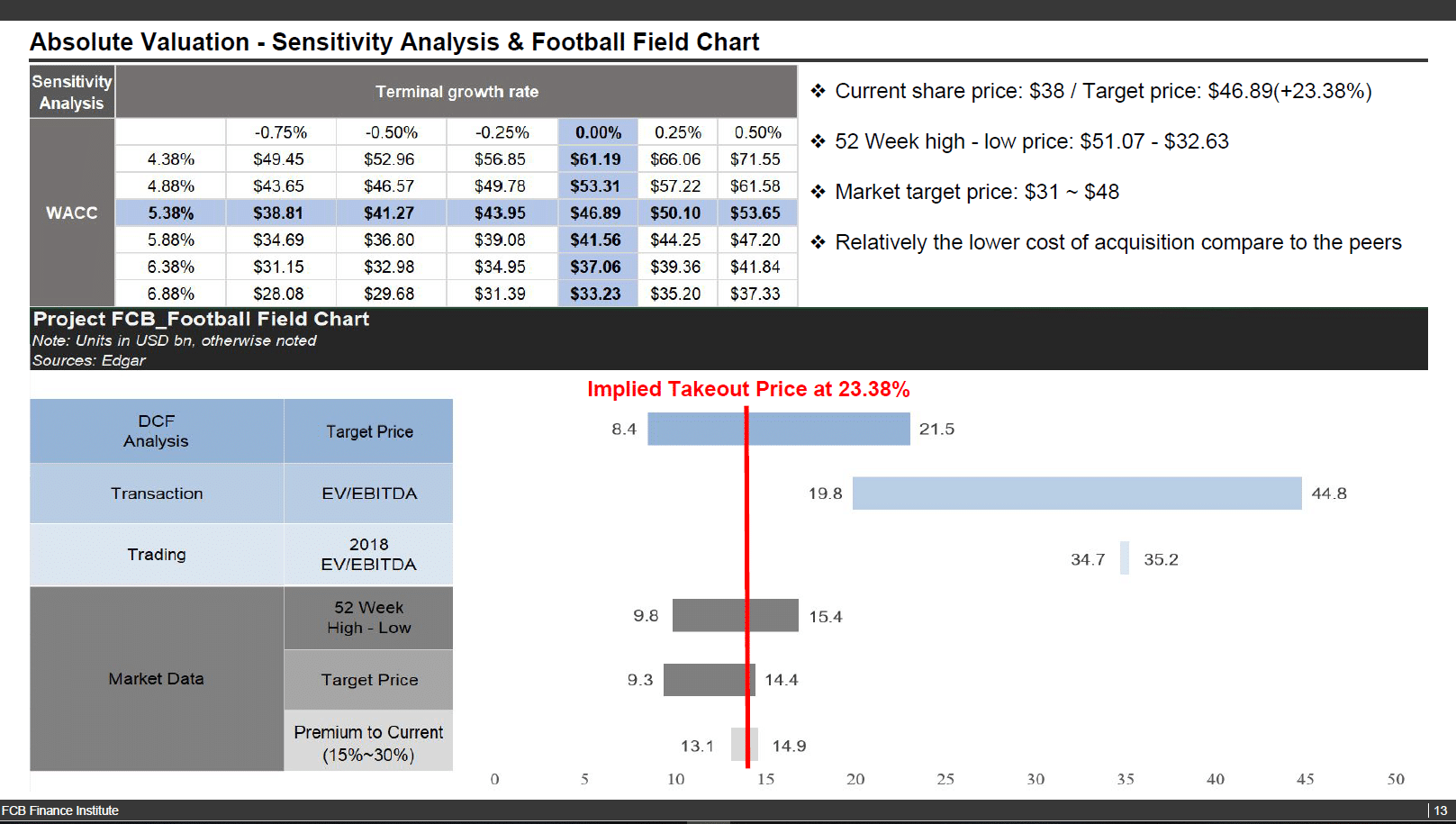

- Part 5. Investment Highlight

Project Leaders

Hoe, Tae Young

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Kim, Seong Jae

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Song, In Hee

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Finance Project Portfolio

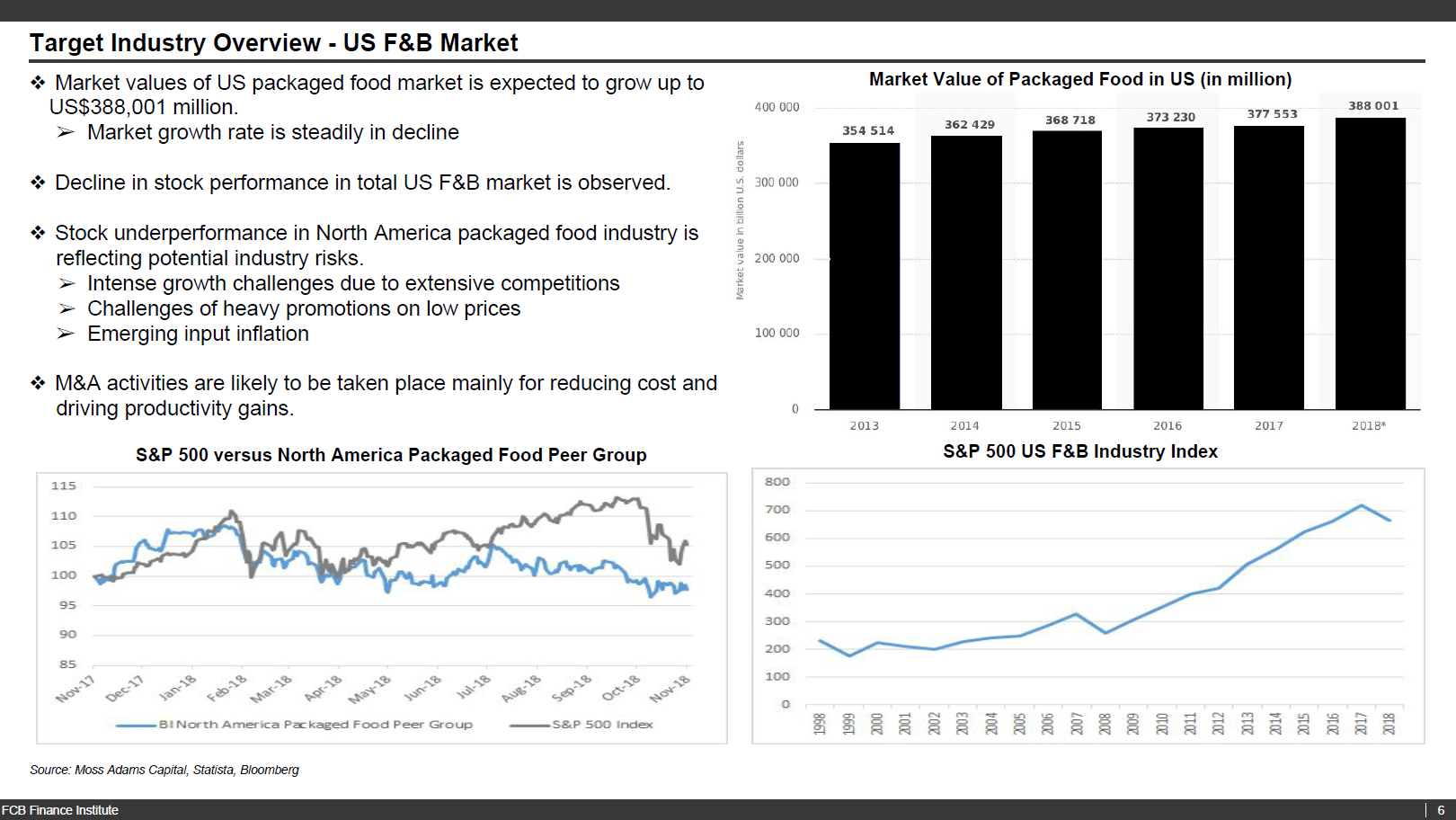

Part 1. Target Industry Overview – US F&B Market

The current United States Food and Beverage market has an excessive number of competitors. The slow growth of United States Food and Beverage market value reflects the saturation of the US F&B market. Moreover, the decline in S&P 500 US F&B Industry Index in 2018 implies underperformance of F&B companies in the stock market. In addition, the cross point in S&P 500 versus North America Packaged Food Peer Group indicates the declining stage of the packaged food industry. The potential industry risks in the industry encourages the M&A activities mainly for cost reductions.

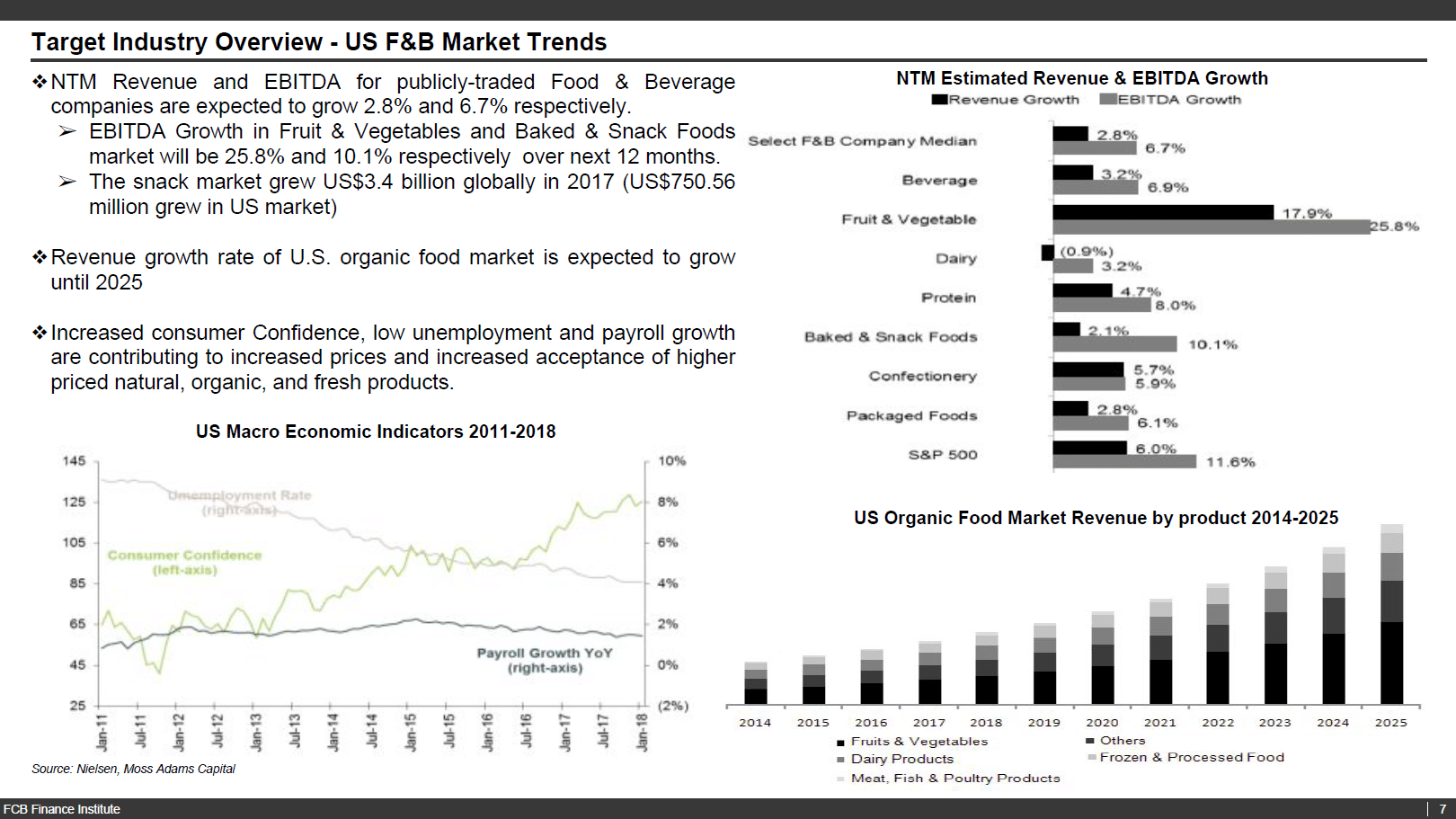

Part 2. Target Industry Overview – US F&B Market Trends

NTM Estimated EBITDA Growth table indicates the future growth of the Fruits & Vegetables (Organic) market and Baked & Snack Foods market. The US Organic Food Market Revenue forecasts the exponential future growth of the organic food market. In addition, positive performances of the macro economic indicators such as increased consumer confidence, low unemployment and payroll growth contribute to increased acceptance of high prices of organic foods as well as increased price of F&B products.

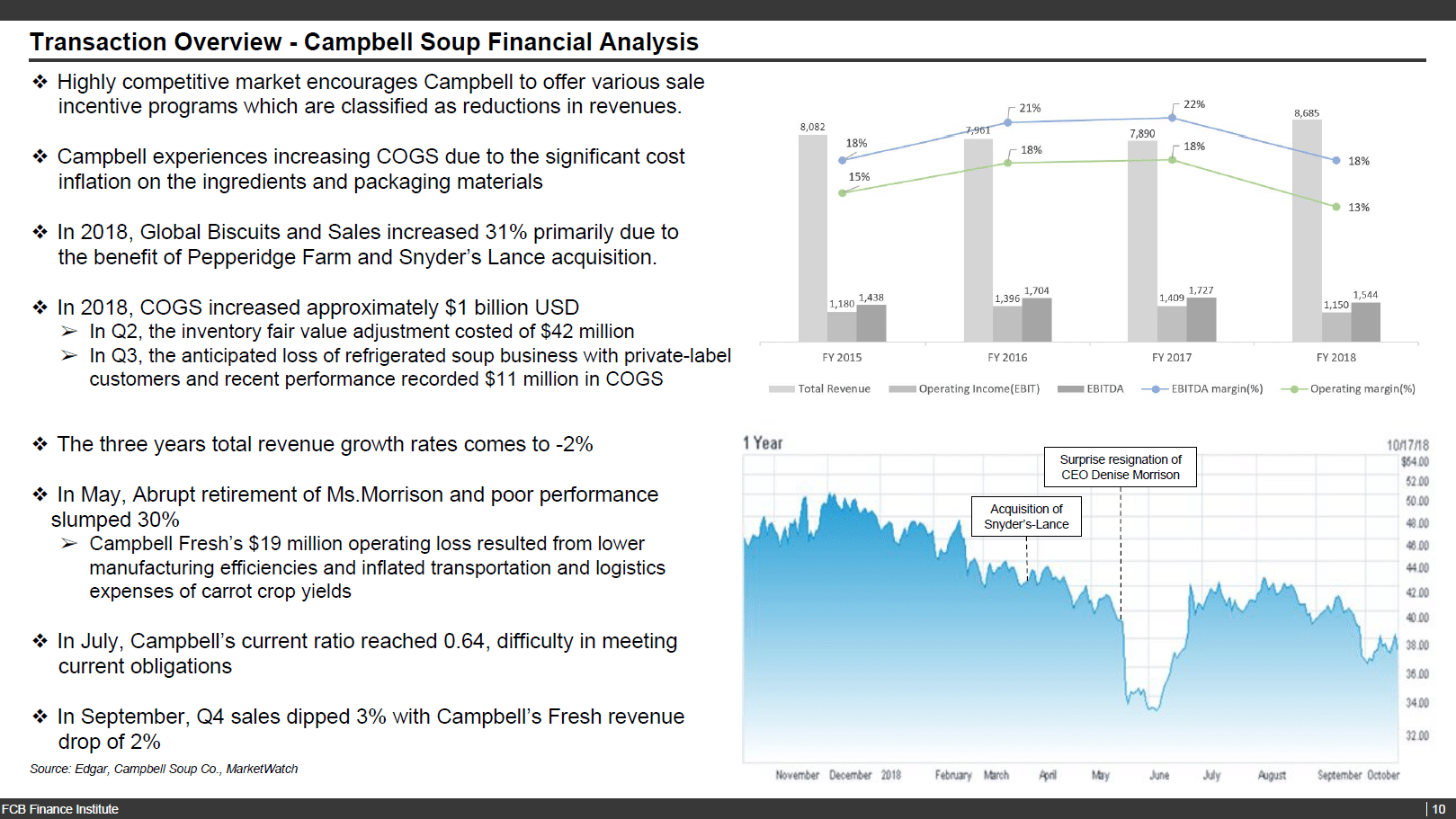

Part 3. Transaction Overview – Campbell Soup Financial Analysis

After acquisition of the Snyder’s Lance, a global biscuits and snacks company, in 2018, Campbell Soup experienced a 31% sales increase. However, the EBITDA and Operating Income decreased approximately 200 to 300 million USD from 2017 to 2018. The EBITDA margin(%) and operating margin(%) plunged 4 to 5%. The competitive US F&B market encourages companies to offer price discounts and sales incentive programs to survive in the industry. As a result, sales of discounted price products decrease the EBITDA and OI. In addition, the cost inflation on the intermediate goods and packaging materials such as paperboards and flexible films reduced the earnings in 2018. Campbell Soup has negative stock performance which reflects the poor business performances. Furthermore, the abrupt resignation of CEO Denise Morrison contributed to huge plunge in May. Therefore, acquisition of Campbell Soup would be considered as a risk-bearing, but there is a possibility of acquiring it at relatively lower premium. Also, it has promising product segments which will have still room for growth.

Part 4. Investment Rationale

The acquisition of Campbell Soup enables the cost efficient production. Redistributing intermediate goods to different manufacturing facilities enhance the management of unfinished goods. As a result, reduction of the percentage of leftover unfinished goods is expected. Moreover, the vertical integration of similar products will reduce the COGS with increasing the net income. A highly diversified product portfolio of Kraft Heinz after the acquisition of Campbell Soup will enable Kraft Heinz to gain higher market share in the F&B industry. In addition, Kraft Heinz can benefit from the product segments which are still promising to grow with setting off the potential loss from intense competitions in packaged foods segment.

Part 5. Investment Highlight

The underperforming Campbell Soup’s share price makes it possible for Kraft Heinz to complete the deal via share acquisition with much lower costs. The deal is expected to create a synergy effect which results in lower operating expenses. Empirical evidence from the previous deal suggests that two firm’s overlapping operating expenses will be reduced by at least 4% after the merger. Furthermore, strategic reorganization of Campbell Soup implies improved production efficiency will be added to its value chain. Campbell Soup’s dominance in the U.S. soup industry will add sales figures of at least 4,000 million U.S. dollars to the business. Kraft Heinz also can absorb outputs from Campbell Soup’s accumulated R&D for Campbell Soup Campbell Soup has been continuously maintaining high R&D expenses (around 100 million U.S. dollars per year).

Appendix.

Join a Finance Project

서류, 면접에서 활용할 금융권 포트폴리오를 만들고 싶으신가요? 프로젝트를 통해 실무와 네트워킹을 한번에 해결할 수 있습니다. 도전하세요!