Project Background

This pitch book proposes acquisition of Kolmar Korea to Unilever, which recently acquired Carver Korea. Since Unilever acquired a cosmetic brand, acquiring OEM/ODM company will enable its own production of the brand. Furthermore, demand for stable OEM/ODM has surged as local Chinese cosmetic brands have grown rapidly in recent years. However, Chinese local cosmetic OEM/ODM companies lack R&D technology and facilities to meet recent high increase of demand, and the quality of finished products is also disappointing. Therefore, acquiring Kolmar Korea would enable Unilever to produce its brand products and also fulfill the demand of Chinese local cosmetic brands.

- Part 1. Target Company Overview: Business Information

- Part 2. Target Company Overview: Financial Analysis

- Part 3. Cosmetic ODM/OEM Industry Overview

- Part 4. China Cosmetic Market Insight

- Part 5. Valuation Overview

Project Leaders

Shin, Jae eun

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Lim, Jason

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Oh, Su min

Finance Project Member

FCB Finance Institute

Concentration Area: M&A Advisory

Finance Project Portfolio

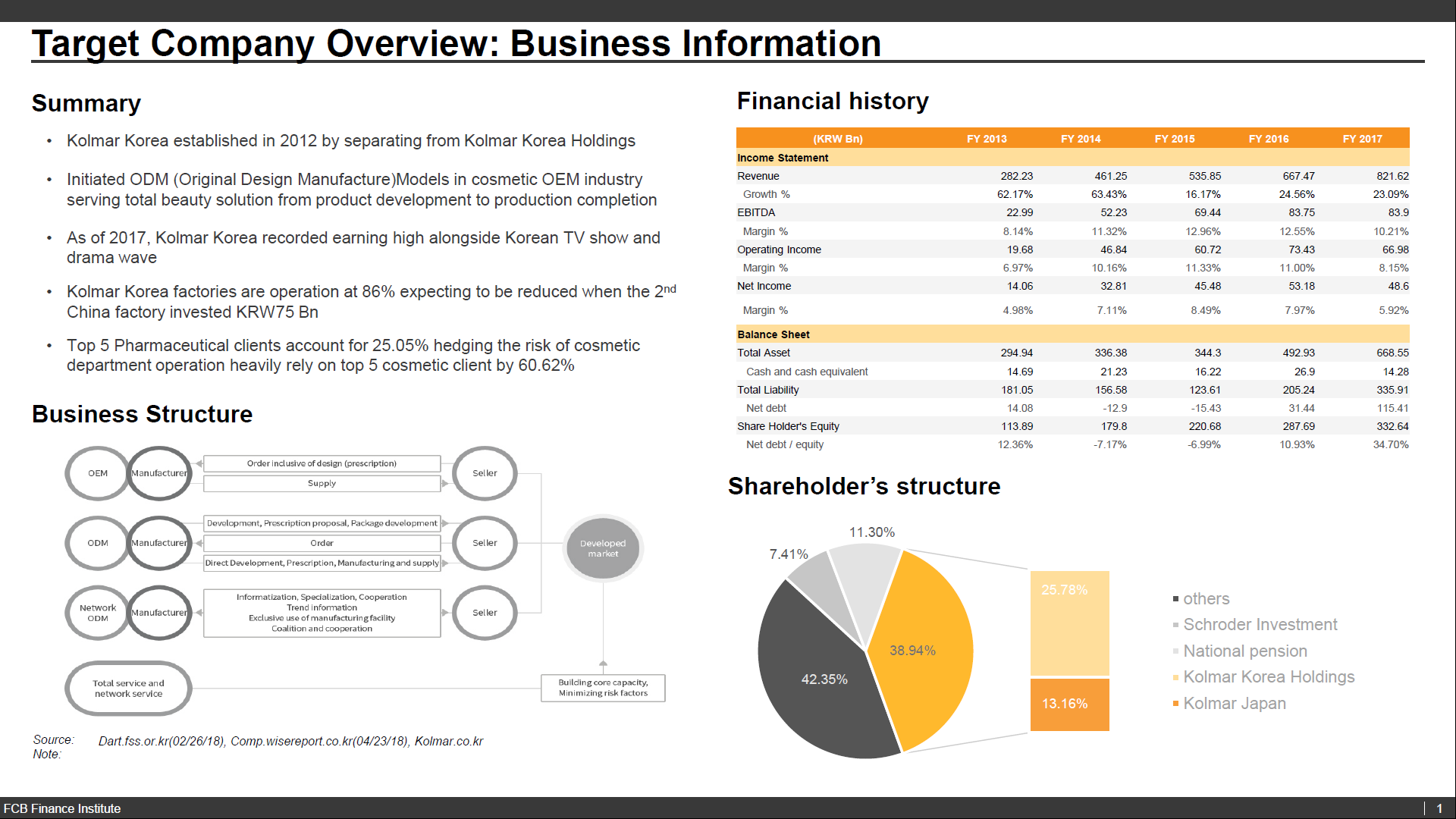

Part 1. Target Company Overview: Business Information

Kolmar Korea is a cosmetics OEM/ODM company, which is a subsidiary of Kolmar Korea Holdings. Kolmar Korea’s major strengths in cosmetic manufacturing markets are: 1) ODM total consulting 2) world-class basic cosmetics technology and number of cosmetic manufacturing patents 3) excellence in product manufacturing. Kolmar Korea was the first in Korea to introduce the ODM service, which consists of every process from product planning, development, to manufacturing. Moreover, the factory’s production capacity rate is approx. 86% with new plant being built in China with manufacturing ability of 400 million products annually. This is a strategic decision based on increasing orders from Chinese cosmetic companies as demand soars and Chinese cosmetic brands trusting Korean manufacturers more than before.

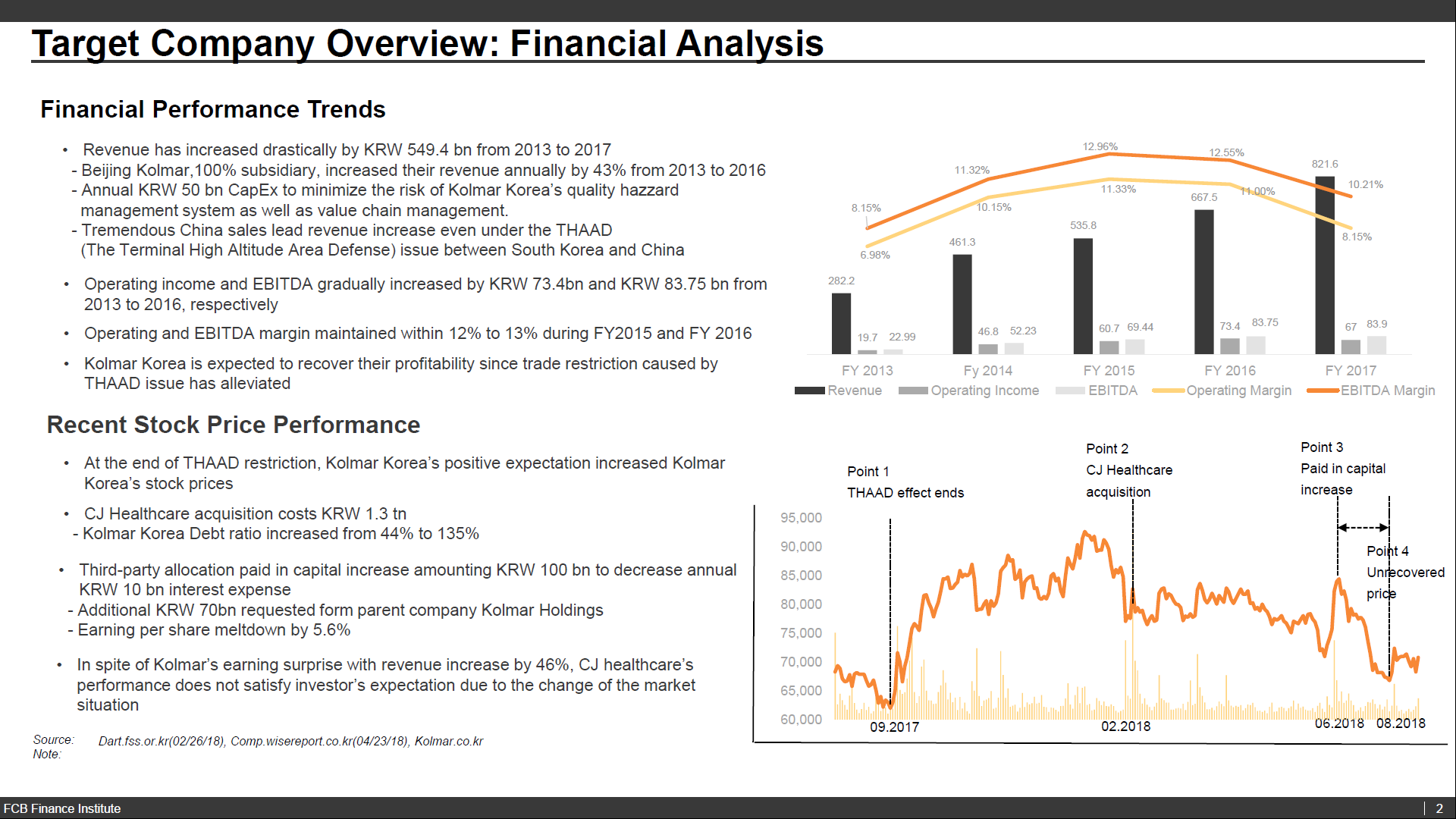

Part 2. Target Company Overview: Financial Analysis

2017 had been harsh for Korean cosmetic companies. The more Korean cosmetic companies relied on Chinese market, the less they were able to response quicker from the market risk from a political conflict caused by THAAD issue. While most of the Korean cosmetic companies were experiencing a sharp drop in sales, Kolmar Korea recorded an increase in sales by 130 billion Won. Kolmar Korea’s ability to record approx. 33.46% in sales growth rate every year and generate steady cash flow with 10% in EBITDA/sales can be very attractive to Unilever, a company actively seeking to expand their market share in Chinese cosmetic market. Currently, Kolmar Korea has acquired CJ Healthcare and is planning to expand their pharmaceutical OEM/ODM services. Due to excessive M&A efforts, unreliable debt management, and earnings under market expectations, the company is currently undervalued.

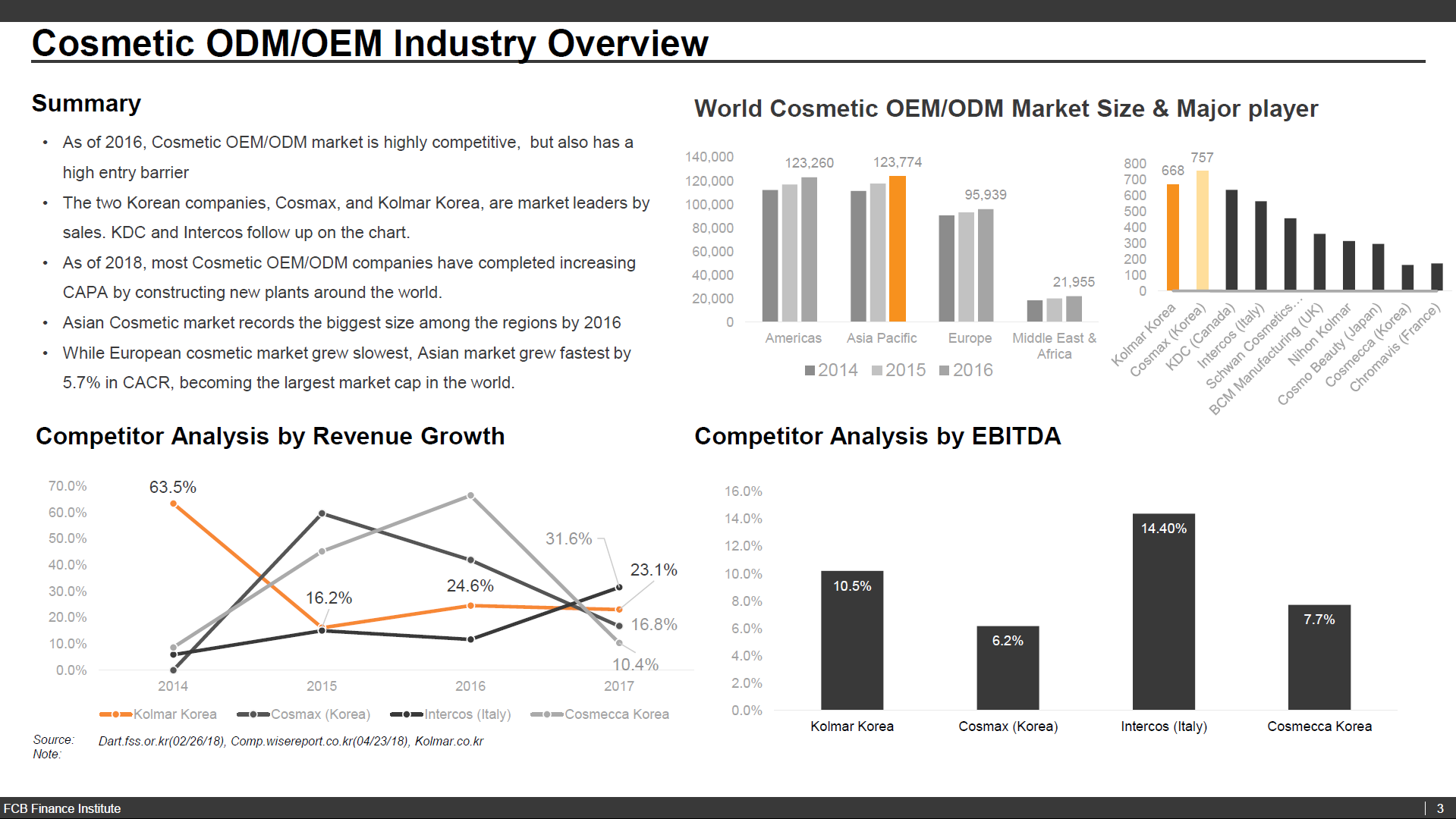

Part 3. Cosmetic ODM/OEM Industry Overview

Cosmetic OEM/ODM market is high competitive, but the level of entrance to the market is also high. Currently, Korea’s OEM/ODM market is dominated by Kolmar Korea and Cosmax. Both of these companies have an overwhelmingly high market share not only in Korea but also globally. Most OEM/ODM companies are increasing their production capacity, and especially Asian cosmetics market is growing faster. In fact, Asia recorded the largest sales in the cosmetic OEM/ODM market by continent in 2016. Kolmar Korea is generating the highest EBITDA among domestic TOP3 cosmetic OEM/ODM companies.

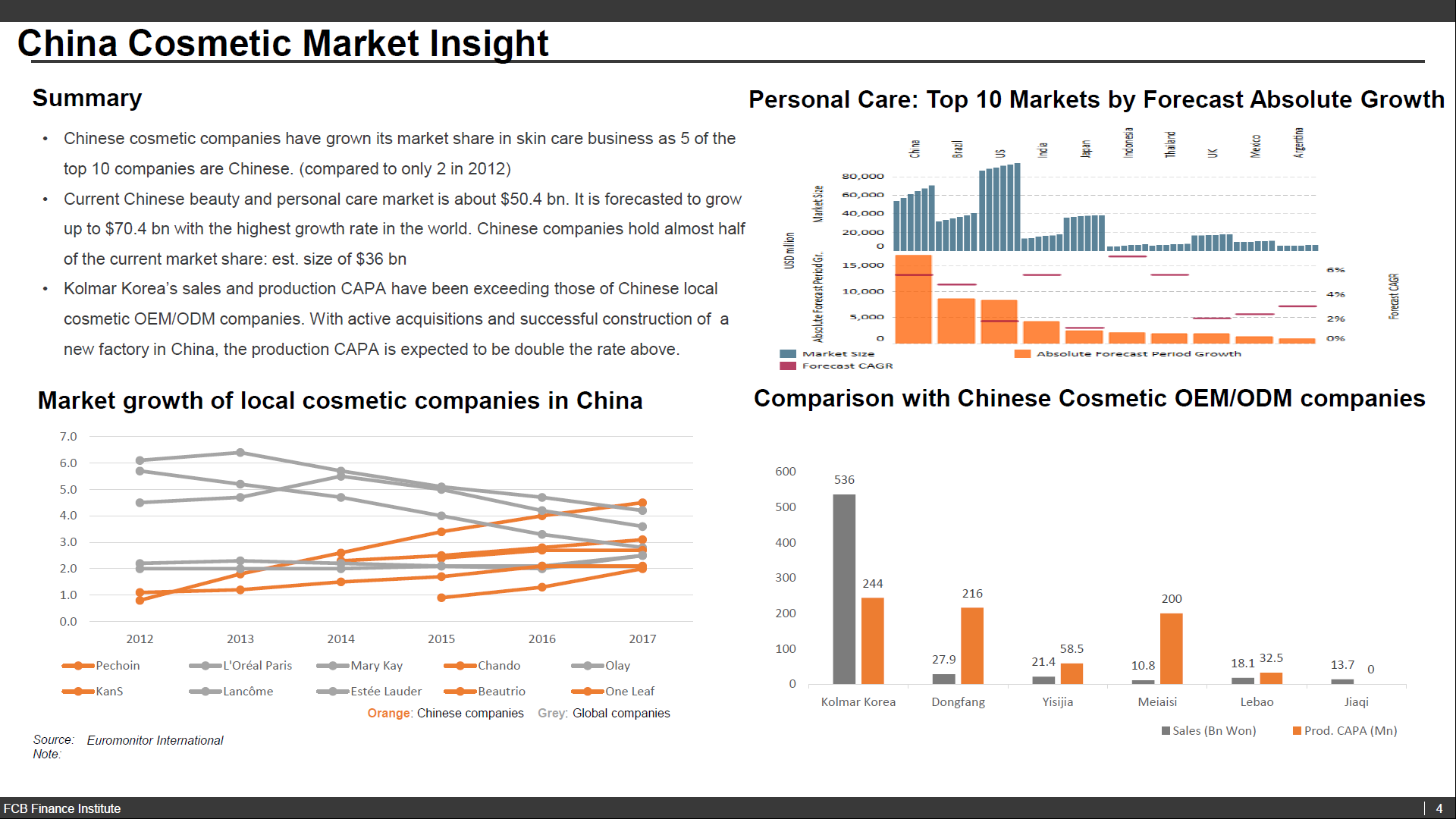

Part 4. China Cosmetic OEM/ODM Market Insight

The potential of the Chinese market has always been highly valued, but the cosmetics market’s growth is even more remarkable than other industries. The fact that local cosmetic brands in China have successfully occupied almost half of total market share implies fastly growing competitiveness of Chinese brands as well as global brands’ failure to accurately target Chinese consumers. Based on the data in 2017, 5 Chinese cosmetic brands are placed in top 10, which are positioned evenly in both premium and value brands. However, despite the explosive growth in demand, there are not many cosmetic manufacturers in China that are able to supply stably. Considering current situation, Kolmar Korea’s production ability based on outstanding R&D technology will play a leading role in Chinese cosmetic manufacturing market.

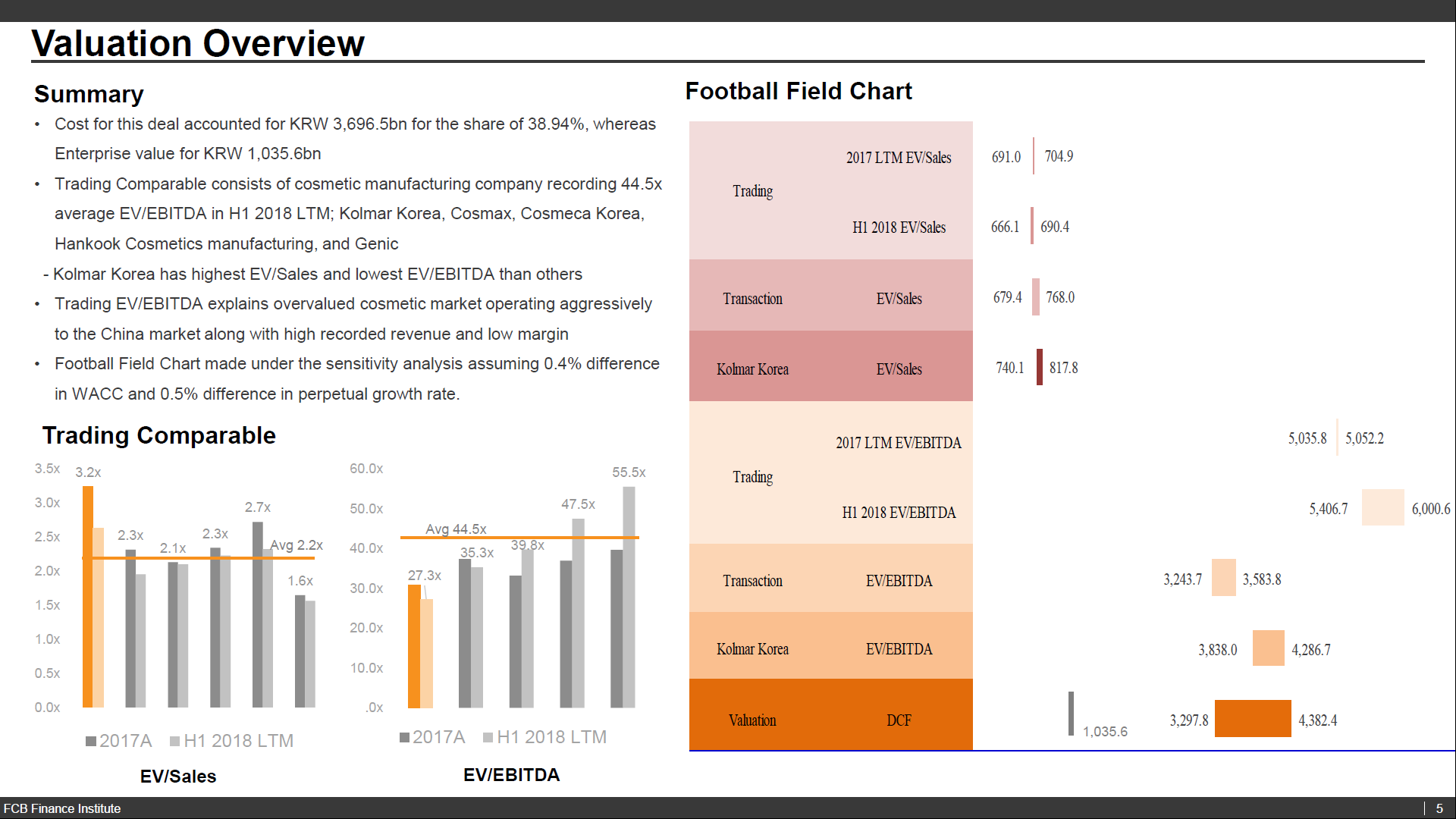

Part 5. Valuation Overview

Currently, companies in cosmetic manufacturing industry are highly valued with 44.5x EV/EBITDA based on H1 2018 LTM. The reasons are: 1) expectations for rapid market growth in China; 2) temporary growth in sales due to the effect of Hallyu wave; and 3) aggressive investment in plants and equipments. At this moment, the transactions of cosmetic manufacturing companies are mostly in a win-win format that is a collaboration of manufacturing companies selling themselves from the result of bad financial management and buyers looking to invest for expanding cosmetic distribution channel. As a result, transaction comparable’s EV/EBITDA is relatively low at 25.3x. According to the DCF model, Kolmar’s value in the current market is relatively undervalued with EV/ EBITDA of 30.9x and is considered attractive enough for an investment.

Join a Finance Project

서류, 면접에서 활용할 금융권 포트폴리오를 만들고 싶으신가요? 프로젝트를 통해 실무와 네트워킹을 한번에 해결할 수 있습니다. 도전하세요!