LG Display Equity Research Report Case

Project Background

Today, we cannot talk about human life except IT devices such as TV and Smart phone. LG display leads the LCD industry with the best and first-time technology no one has tried. The emergence of Chinese companies is threatening the LCD business. However, LG display is preparing for a second leap forward by soaring the demand for IT devices. Therefore, by analyzing LG Display, which is currently producing the highest level of technical capability in large OLED TVs, we will learn about trends in overall display industry and future prospects.

- Part 1. Target Company Overview: Business Information

- Part 2. Target Company Overview: Financial Analysis

- Part 3. Display Industry Overview

- Part 4. Investment Highlight

- Part 5. Valuation Overview

- Part 6. Appendix A

Project Leaders

Noh, Jung Kyoon

Finance Project Member

FCB Finance Institute

Concentration Area: Equity Research

Kim, Hyo Jin

Finance Project Member

FCB Finance Institute

Concentration Area: Equity Research

Park, Jin Sun

Finance Project Member

FCB Finance Institute

Concentration Area: Equity Research

Kim, Yong Song

Finance Project Member

FCB Finance Institute

Concentration Area: Equity Research

Finance Project Portfolio

Part 1. Target Company Overview: Business Information

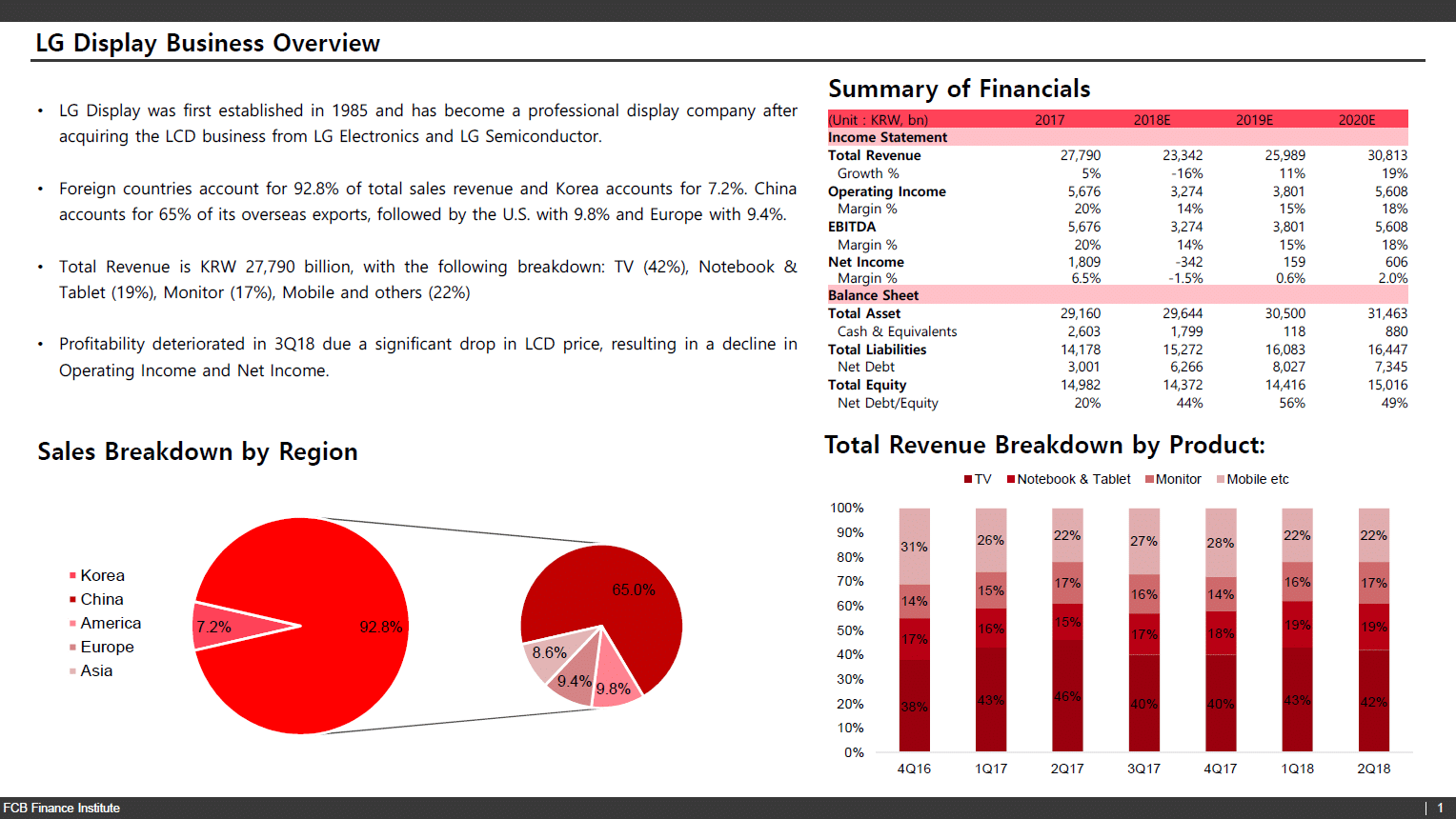

By taking over the LCD business from LG Electronics and LG Semiconductor in 1998, LG Display became the largest LCD TV maker in the world, accounting for 25 percent of the global market. A major advantage of LG Display in display markets is its stable yield on large OLED TVs. Despite of concerns from industries that large-scale OLEDs will have a hard time for mass-producing them, LG Display has eased these concerns by releasing 77-inch UHD OLED TV panels. As profitability of LCD business has decreased due to excessive competition, it is trying to convert 10.5th generation facilities in Paju into OLED plant and operate of OLED plant in Guangzhou in China.

Part 2. Target Company Overview: Financial Analysis

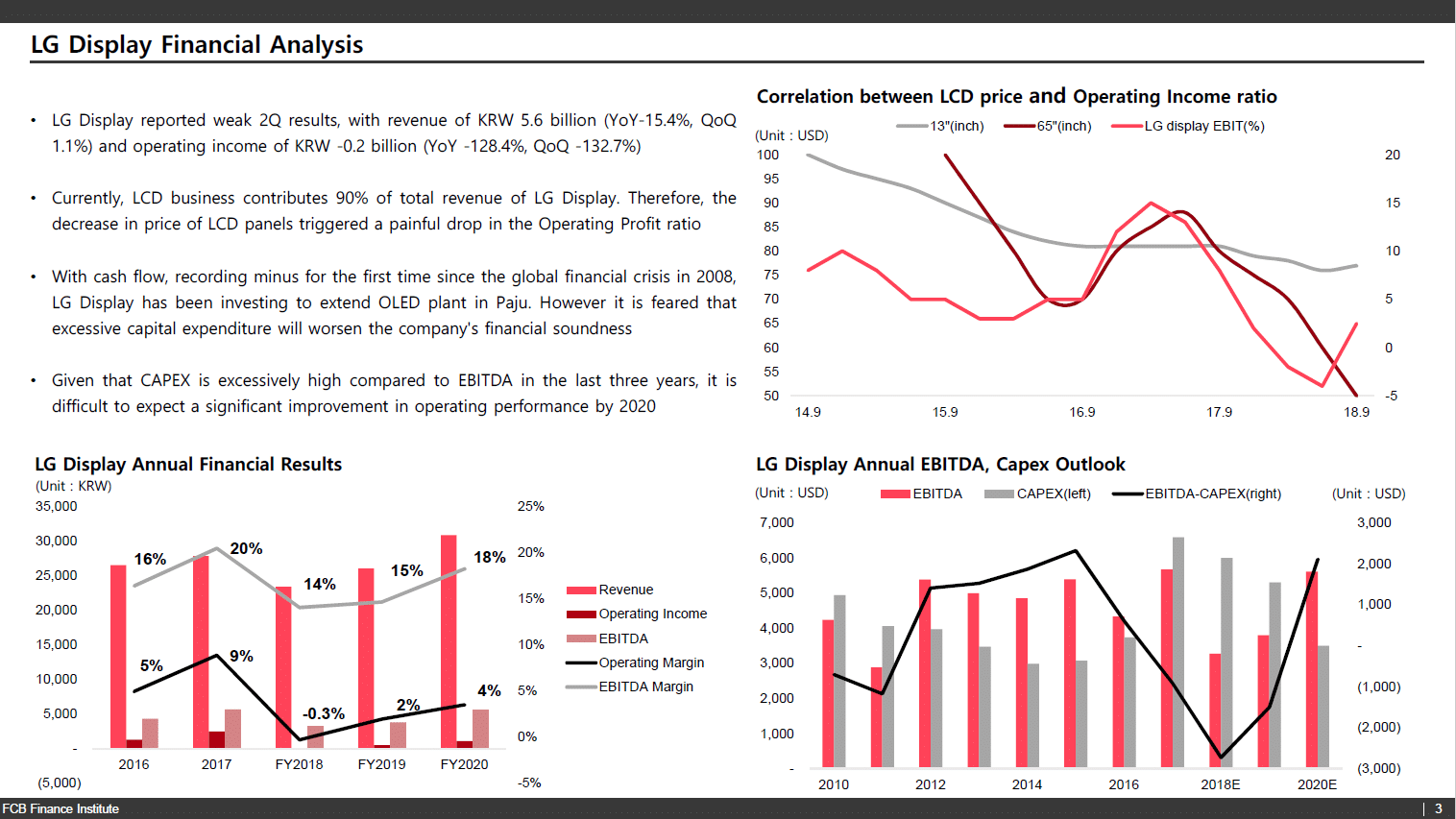

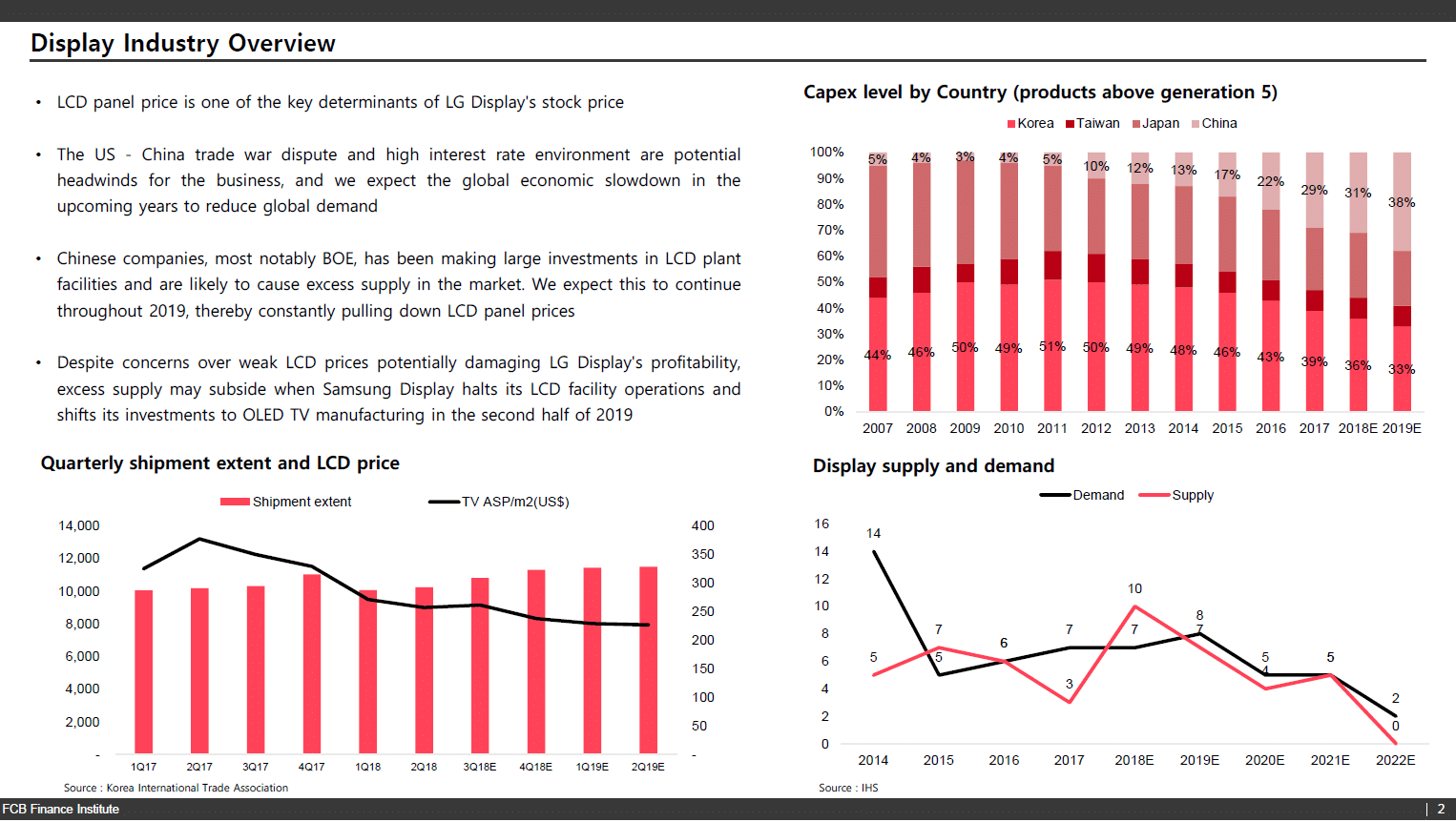

2018 has been hard for the LG display. A temporary increase in price of LCD panels in third quarter of 2018 helped increase profits. However, the price of LCD is still in a down cycle and in the long run, it is expected to fall again by the first half of next year. Furthermore, while the cash flow are worsening due to the excessive capital expenditure compared to EBITDA, LG Display is forced to borrow money from the banks. As a result, the debt ratio is expected to rise from 78 percent to 113 percent. The financial soundness of the LG display is going to be worsen due to constant drop in the price of the LCD panel and excessive capex. However, turning point is likely to be in the first quarter of 2020 with the full scale of the OLED market expansion and LCD panel price rise again.

Part 3. Display Manufacturing Industry Overview

Display industry is high competitive, but there are high barriers to enter market. Currently South Korean market is occupied by Samsung Display and LG Display. Both companies have absolutely high market shares, but they have recently been losing their shares due to large capa investments by Chinese companies. Although LCD was major technology in the past, it is expected that OLED will replace much of markets in the future. Therefore, Korean companies are making large investments in OLED. The point is that there is possibility that price of LCD panel will increase since second half of 2019 when the companies convert LCD factory to OLED factory because LCD operation will be stopped. Therefore, stock price of display companies is going to rise as price of LCD panel increases.

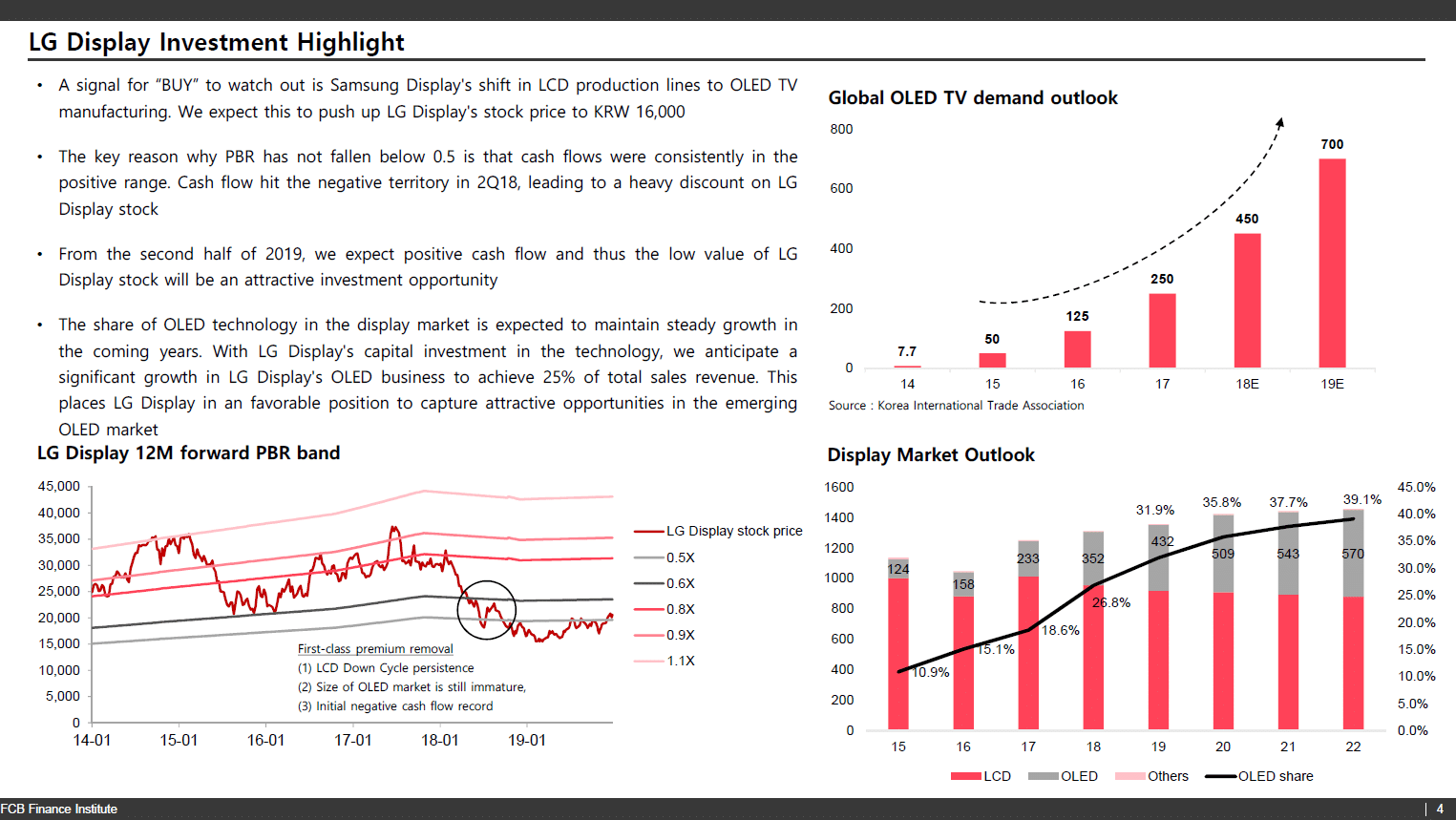

Part 4. Investment Highlight

The potential of the display market is huge. As the fourth industrial revolution has become trend, display panels are being used not only for existing IT products such as mobile devices, TVs, laptops and others but also for variety of products such as cars, lights and watches. Furthermore, As current LCD products trend have changed towards OLED products with better functions, demands are increasing at the same time. This can serve as big opportunity for LG Display, which has high technical skills in OLED sector. In addition, as supply of POLED panels to Apple was actually signed in fourth quarter of 2018, POLED business that had been highlighted as weakness is being supplemented. If three factors, such as the OELD market expansion, falling LCD panel prices and low multiple-PBR, occur at the same time from 2020, this could be the second best time.

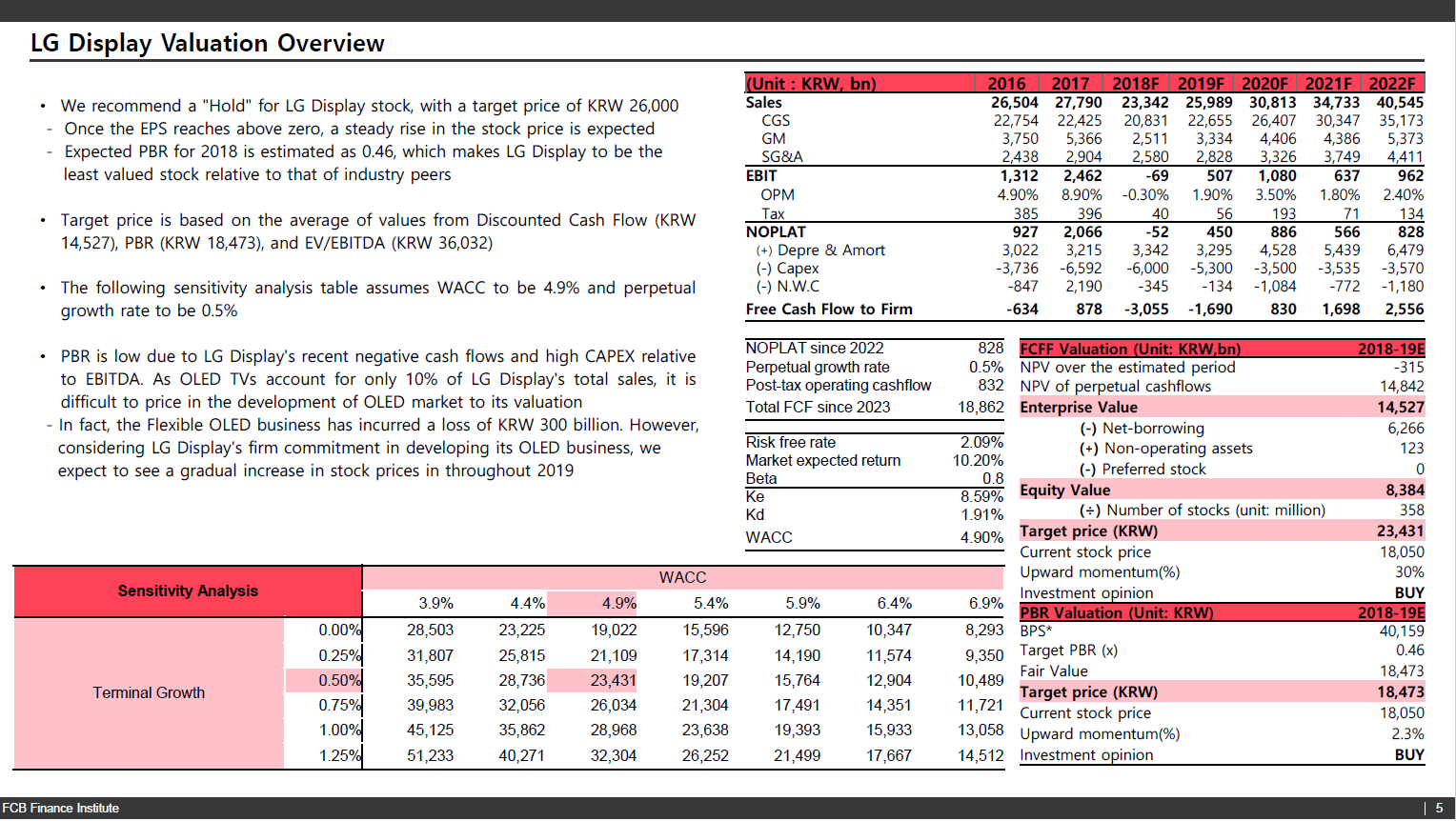

Part 5. Valuation Overview

Currently, most companies in the display industry are generally undervalued with 0.46x PBR based on 2018E. The reasons are:

1) Increased bleeding competition and oversupply by Chinese companies’ additional LCD plants building;

2) The Chinese government’s huge subsidy policy for Chinese display companies

3) LG Display’s cash flow deficits and additional borrowing and financial burdens for investment in OLED plants building.

The low PBR already reflects all the bad news on the stock market. Therefore, if LCD panel price increase in a long-term perspective and technology gaps are maintained, it is considered attractive enough for an investment

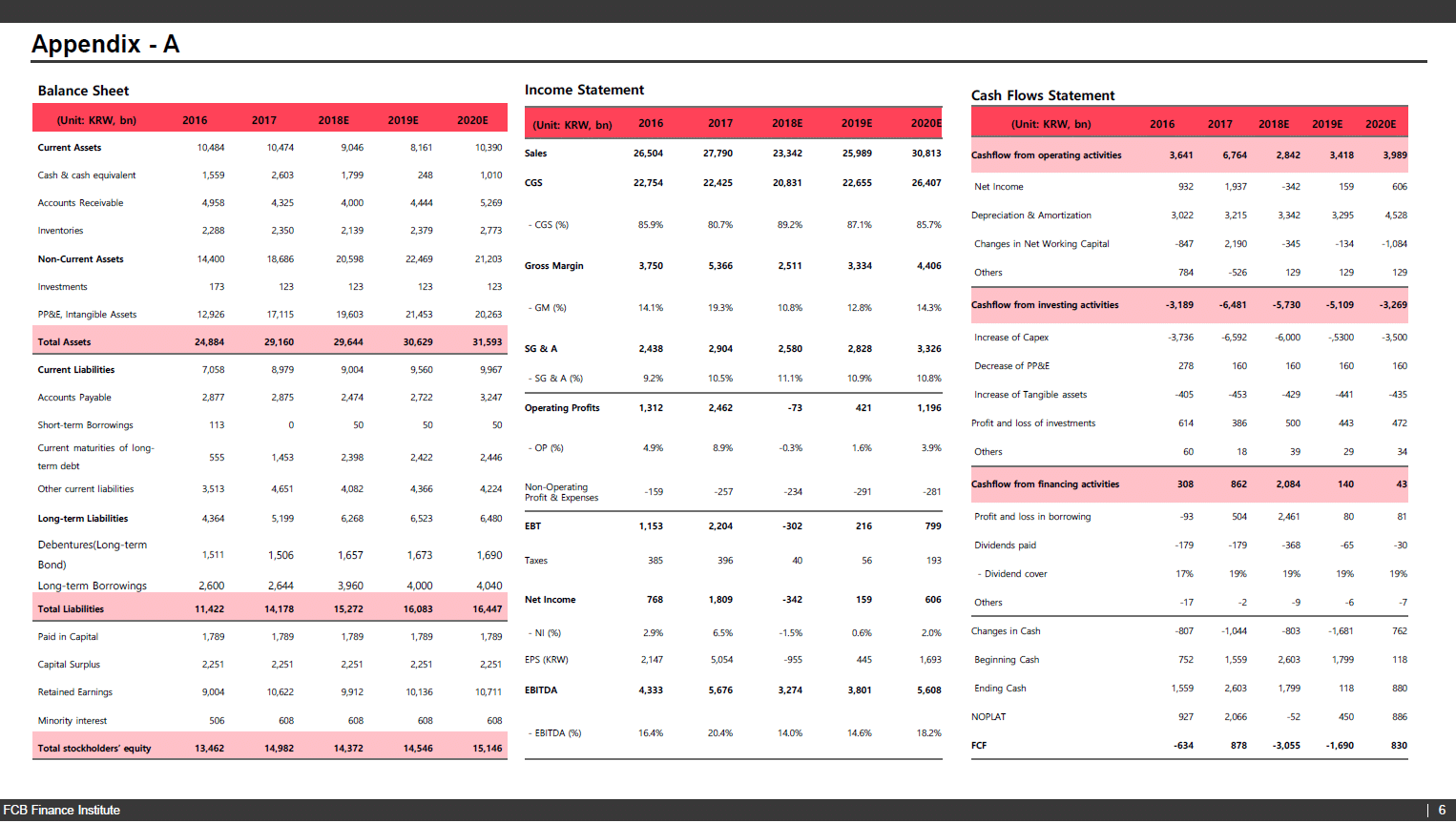

Part 6. Appendix

Appendix is an additional data on modelling. Appendix A explains specific financial statements ; Balance Sheet, Income Statement, Cash Flows Statement.

Join a Finance Project

위와 같은 자신만의 금융권 포트폴리오를 만들고 싶으신가요? 이하의 국가별 파이낸스 프로젝트에 참여하셔서 본인의 금융권 커리어를 발전시키시길 바랍니다.

퀀트 부서 현업 선배님과 함께하는

5주 포트폴리오 작성 프로젝트

대체투자 현업 선배님과 함께하는

5주 부동산 실물 평가 프로젝트